It’s something that all of us, even traders themselves, have suspected — traders are even more psycho than the average psycho!

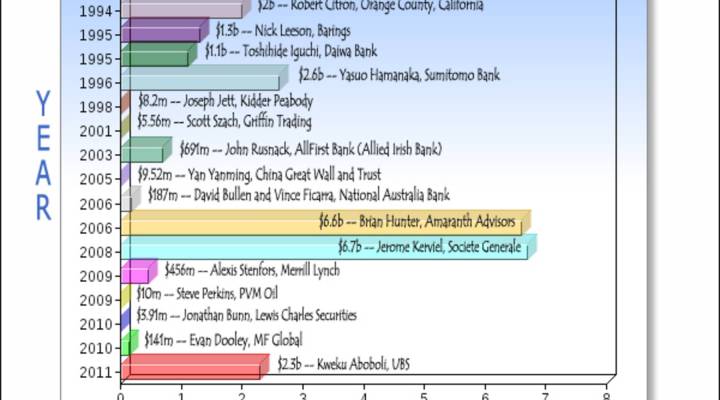

That’s the result of a study from the University of St Gallen in Switzerland, Der Spiegel reports. Researchers ran tests on 28 traders, and found that stockbrokers’ behavior is more reckless and manipulative than that of psychopaths. See the most rogue traders in the graph below.

That news, coming as it does in the midst of a mild financial crisis, nearly halted the Marketplace Daily Pulse altogether today and had us calling for a crash cart.

But after we recovered, we realized that this shouldn’t come as a surprise. After all, who else but a bunch of self-interested, narcissistic sociopaths could have brought us to the brink of financial collapse. It made some of us here wonder how Tea Party-affiliated Representatives would have done on the test.

And the idea of finance guys being deranged isn’t new, by any means. in American Psycho, Brett Easton Ellis created Patrick Bateman, a magnificently sociopathic character interpreted memorably by Christian Bale. And then there’s Jack The Ripper, who wielded his blade a short stroll down Cornhill and Leadenhall Street from London’s Royal Exchange.

Thomas Noll is a lead administrator at the Pöschwies prison north of Zurich, and a co-author of the University of St Galen study. He told Der Spiegel, “Naturally one can’t characterize the traders as deranged, but for example, they behaved more egotistically and were more willing to take risks than a group of psychopaths who took the same test.”

Particularly shocking for Noll was the fact that the bankers weren’t aiming for higher winnings than their comparison group. Instead they were more interested in achieving a competitive advantage. Instead of taking a sober and businesslike approach to reaching the highest profit, “it was most important to the traders to get more than their opponents,” Noll explained. “And they spent a lot of energy trying to damage their opponents.”

Using a metaphor to describe the behavior, Noll said the stockbrokers behaved as though their neighbor had the same car, “and they took after it with a baseball bat so they could look better themselves.”

The researchers were unable to explain this penchant for destruction, they said.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.