Muslim mortgages

TEXT OF STORY

Tess Vigeland: This week we’re bringing you our part of a special Marketplace series called “The Middle East at Work.”

Today we’re looking at some of the personal money issues that connect the Middle East and Middle America and Scott, here’s a big problem both here and there, in Egypt: housing.

Scott Jagow: Yes, Cairo has about 18 million people, but it was designed for about a third of that or less, so you have what you might call slums spilling out into the desert, very informal housing communties, and these apartments are cramped; we vistied a couple. People can’t afford to live on their own, so you have adult children living with their parents.

And then there’s the issue of how you even buy a house. Interest is forbidden in Islam.

Vigeland: That’s right: you can’t charge interest and you can’t pay interest, so that made us wonder how Muslims here in the U.S. deal with mortgages.

Vigeland: Hi!

Mourad Zerroug: Hi, very nice meeting you.

Vigeland: Very nice meeting you as well. Thank you for inviting me.

Zerroug: Please, come on in.

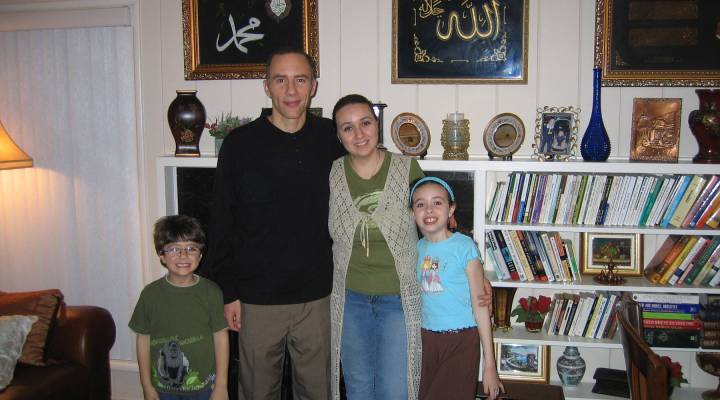

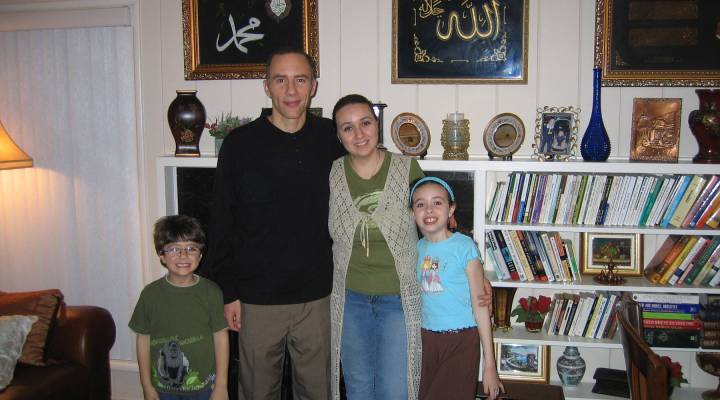

Vigeland: Mourad Zerroug invited me to visit his home a few weeks ago, where his wife Amina cooked us a dinner of fish with a Northern African bread called Kesra and a salad of diced roasted peppers and onion dressed in a rich, fruity olive oil from their home country of Algeria.

Vigeland: It smells wonderful!

Zerroug: I hope you like it as well.

Mourad is 43. His wife Amina is 34. They, their 8-year-old daughter Hanaa and 5-year-old son Youssef, live in a three bedroom, two-bath ranch house in Pasadena, Calif.

Zerroug: We’ve been living here for a little over five years. We bought it in the summer of 2002. We were first time buyers and we liked the neighborhood very much. The house is about the size of what we were looking for.

But there was one potential hitch in the plan…

Zerroug: In Islamic law, Islamic beliefs, interest is forbidden.

That means a conventional U.S. mortgage is not an option for observant Muslims, so Zerroug and his family turned to American Finance House LARIBA, the largest Islamic mortgage lender in the country.

LARIBA means Riba-free. Riba is the Islamic word for interest.

Yahia Abdul-Rahman: You cannot charge money for the use of money.

Dr. Yahia Abdul-Rahman is the bank’s founder.

Abdul-Rahman: That is what the Old Testament teaches and the New Testament teaches, the Jewish Bible teaches, and the Koran teaches. They all agree that money is a thing. We call it socially-responsible, faith-based financing, which is essentially what Jimmy Stewart was trying to do in his movie “It’s a Wonderful Life:”

[clip from “It’s a Wonderful Life”:] Just remember this, Mr. Potter, that this rabble you’re talking about — they do most of the working and paying and living and dying in this community. Well, is it too much to have them live and work and pay and live and die in a couple of decent rooms and a bath?!

Abdul-Rahman: My job as a banker is not to dig a deeper hole of debt for my customer.

So Abdul-Rahman devised a way to finance mortgages without charging interest. It’s essentially a lease-to-own, but you take title on the house. To determine your repayment, you and the bank get estimates from six different realtors about what the house is worth as a rental, then you negotiate a monthly payment based on those figures. The bank makes its money off part of that payment.

Abdul-Rahman says not only does this process avoid interest, but because rental rates are a good indicator of home value, it means the bank and its customers won’t overpay for properties. He cites the example of a friend who wanted to buy a home in Phoenix:

Abdul-Rahman: And a real estate broker was pushing him to buy a home for $286,000. We did our due diligence. It turned out that our assessment of the value of this home was about $200,000 — based on the rental evaluation. The broker called us up and he scolded us and we still told him “don’t buy the house.” This house today is about $185,000.

The process of using rental rates to determine a home’s real value kept American Finance House out of the subprime mess. The bank has had no foreclosures in its portfolio.

Mourad Zerroug says even though Muslim mortgages might seem more complicated than what most Americans are used to, the biggest difference is in how monthly payments are set and what those payments is based on.

Zerroug says given the current housing market morass, traditional banks could learn a lesson or two from LARIBA:

Zerroug: I think this at least in my opinion should serve as an example of what can be a fair model of look at what’s reasonable, what can be paid. The bank itself would not lend to a person who they know is not able to pay back the loan.

Who knew that one day that would become a novel concept?

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.