TEXT OF INTERVIEW

Kai Ryssdal: Today Bank of America CEO Ken Lewis showed why he’s still got a company to run while so many of his former peers don’t. Lewis is smart enough not to ask for a bonus. He told the board today he’s not interested in extra money after the bank’s performance last year. Of course, 2008 wasn’t all bad for B of A. It managed to snap up its Wall Street competition, Merrill Lynch, and what is arguably the company at the heart of the mortgage mess — Countrywide Financial.

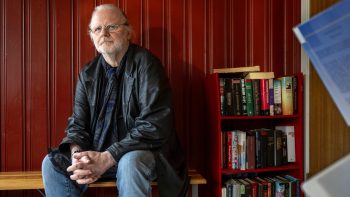

Adam Michaelson used to run marketing at Countrywide, helping generate new customers for what was at the time the biggest mortgage firm in the United States. He’s has written about his experiences in a new book. Adam, welcome to the program.

Adam Michaelson: Thank you for having me.

Ryssdal: So let’s frame this in terms of timing. I mean, you started at Countrywide before any of us had ever heard the word ‘subprime.’

Michaelson: Well, you know, it’s funny. I myself had not heard that much about Countrywide when I interviewed with them. And there’s a portion of the book where I go through the scene by which I was being interviewed and the sparkle in their eyes when they mentioned the dream of home ownership. And this was not like marketing toys, or candy, or technology — this was selling the American dream.

Ryssdal: What was it about this sense of purpose that you guys had that got us to where we are today? I mean, there was a mentality there, that comes through in your book, of we got to get people into homes and this is why we are on this planet.

Michaelson: I speak a lot about Angelo Mozilo, the CEO of Countrywide. And he’s been vilified in many ways in the press, but the man was a hero to many of us in the business. And before the crisis came to pass, for 40 years he helped people get into homes that perhaps they could not have gotten before. When he walked the halls it was like Walt Disney walking the halls and touching your shoulder and telling you that you were doing good for America. So there was a certain paternal pathos there that was infectious. And I’ll tell you, at the time — and I’m sure many people can think back when their housing values were skyrocketing and everybody was getting rich and everything was great — we all honestly believed in the mission that he espoused.

Ryssdal: Here you are, though, a guy whose job it is to get more people signed on to Countrywide’s products. I mean, you know . . .

Michaelson: Well, there’s moral ambiguity inherent in all selling. In fact, I would argue that many of your readers, any of whom have ever been involved in sales, have at one time wondered whether that prospect should be buying that product or could buy that product. But they have goals to make and their job is to sell whatever it is they’re selling.

Ryssdal: One thing, though, to be selling lawn mowers. It’s another thing to be putting somebody, who everybody knows can’t really afford it, into a half-million-dollar house.

Michaelson: Well, that kind of point of view is a very valid point of view. It’s also a populous point of view. But using that argument, we as a nation should decide to vilify fast food companies . . .

Ryssdal: And we do.

Michaelson: And we do. And credit card companies who offer new credit cards to people who owe $50,000 in household debt.

Ryssdal: And we do.

Michaelson: So it’s a much larger issue about, not only the morality of selling, but is it more about the death of personal responsibility? It’s important for us to question was every foreclosed homeowner really a victim? Was every corporation really evil? I think the answer is much bigger than that.

Ryssdal: What is the answer then? I mean, I’m not going to let you get away with just saying, “Well, we have to question these things.” Because the economy’s in tatters, in large part, because of what a company like Countrywide did.

Michaelson: Well, part of the reason I wrote the book is because I started to read stories about foreclosed homeowners and how corporations were all evil and I said, “Wait a minute. I was in the room and I’m telling you, we were not out to hurt people.” Everyone truly believed in the mission of home ownership as a good thing for America.

Ryssdal: I’m a big one for reading the acknowledgments section of a book. And the last word actually in this book, in your acknowledgments, is “And finally to Angelo Mozilo for creating Countrywide in the first place and for pushing us all, at one time, to believe.” It doesn’t really sound like you regret what happened at Countrywide.

Michaelson: Anyone in their right mind regrets what has happened. But to vilify every loan that’s ever been created by any company in this business, I believe is the same rush to judgment that has gotten us into this crisis in the first place. And now that same rush to judgment is helping us blame people quickly without the full view of the story.

Ryssdal: Adam Michaelson used to be a senior vice president of marketing at Countrywide, the mortgage company. His book is called “The Foreclosure of America.” Adam, thanks a lot.

Michaelson: Thanks for having me.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.