If you’ve ever tried to sort through transactions on your own bank statements, you will appreciate the work produced by The Wall Street Journal and ProPublica today to make some sense out of the stack of banking data released Wednesday by the Federal Reserve.

Under orders from Congress, the Fed made an historic data dump on its website, disclosing emergency loans to Wall Street investment banks, U.S. and foreign financial institutions and other companies during the financial crisis. The transactions date from December 1, 2007 to July 21, 2010.

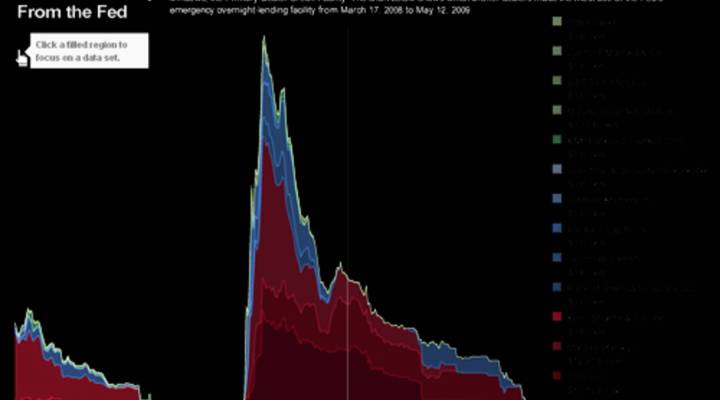

The Journal produced an interactive chart that lets you visualize just how much money various institutions borrowed. ProPublica, meanwhile, made the data available in an easy-to-sort list.

Seeing the data so clearly reveals some interesting facts, which we’re reporting on this week. Here are few highlights:

-

The three banks that tapped the Fed for the most loans are Citigroup (370 loans for $2.4 triilion), Merrill Lynch (266 for $2.2 trillion) and Morgan Stanley(246 for $2 trillion).

-

Goldman Sachs, which had maintained that it didn’t need government aid, borrowed no less than $782 billion from the Fed.

-

Bank of America made 156 trips to the Fed loan window for a total of $931 billion. It bought Merrill Lynch, the second biggest borrower.

-

Washington Mutual went to the Fed eight times, accessing close to $7 billion. J.P. Morgan Chase, which later acquired WaMu, made 46 trips to borrow to the tune of $161 billion.

-

Wells Fargo tapped the Fed 19 times for about $154 billion. And it bought Wachovia, which had 23 loans that totaled roughly $147 billion.

-

Bear Stearns borrowed some $962 billion before its collapse in 2008. Lehman Brothers, the other big investment bank to go out of business during the crisis, borrowed $170 billion.

-

The least amount of money borrowed was a one-time loan by First Merchants Bank for a total of $1 million.

To see the complete list, check out ProPublica’s website and see it in color at The Wall Street Journal.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.