We live in a petroleum-saturated world. Literally.

Despite fears of reserve shortages and declining crude, world oil production has experienced a steady rise in recent years, to the tune of nearly 72 million barrels a day (mb/d) for 2009, up from 65.92 mb/d in 1999.

Oil around the world

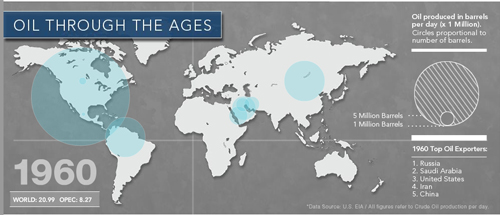

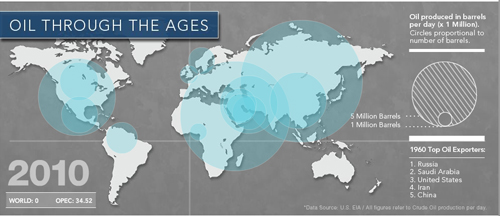

According to industry estimates, the top oil-producing nation in 2010, the last year this data was available, is Russia. Behind Russia is Saudi Arabia, then the United States, Iran, and China. That data is compiled by the U.S. Energy Information Administration (EIA), Business Insider, and the CIA World Factbook.

Worldwide, there are over 70,000 oil fields and wells currently in production, with the bulk of crude coming from a relatively small number of super fields. The world’s largest of those super fields is Ghawar, in Saudi Arabia, which pumps out 5.1 mb/d, about seven percent of global production.

In 2007, output at the world’s 10 largest oilfields totaled 14 mb/d, or roughly 20 percent of world production.

OIL THROUGH THE AGES: view the interactive map

The world according to OPEC

The reported numbers of OPEC and member states have been frequently called into question, with some experts estimating that heavyweights like Saudi Arabia actually overstate their oil production by up to 40 percent in order to spur foreign investment.

The 12 member-nations of OPEC (Algeria, Angola, Ecuador, Iran, Iraq, Kuwait, Libya, Nigeria, Qatar, Saudi Arabia, United Arab Emirates, Venezuela) influence oil prices by restricting production, allocating each member a production quota, keeping prices high by producing at lower levels than they otherwise would. Without finite ways to verify adherence to the quota, member face the incentive to cheat.

A recent Wikileaks cable released by the UK’s The Guardian alleges a geologist and former head of exploration at the Saudi oil company Aramco told the U.S. Consul General between 2007 and 2009 that the nation’s production numbers have been heavily overstated for years (he has since retracted his statement).

“Saudi Arabia has been lying about their reserves for decades,” Jim Rogers, the chairman of Singapore-based Rogers Holdings told Bloomberg in February. “Don’t fall for that. The reason oil is going up is the world is running out of known reserves of oil.”

Colin Campbell, a petroleum geologist and Oxford Ph.D, points out that OPEC’s numerous estimated reserve discrepancies remained surprisingly constant from year to year, before jumping without explanation, often in the absence of exploration, strengthening the notion that OPEC’s reserves are overstated.

Yearly Saudi production data supports a pronounced decline both in-country and regionally, suggesting that the maximum rate of extraction has been reached, leading many to believe the Saudis have already hit peak oil.

Russia output peaks

The first quarter of 2008 saw Russia’s oil market decline for the first time in years, leading many to believe that Russia was the newest-member of the peak-oil club. At that time, Lukoil Vice-President Leonid Fedun told the Wall Street Journal he believed that fall reflected the depletion of Siberia’s older fields.

Many experts question whether global oil production can keep rising to meet the ravenous global demand. Serving the motherland and the European market, Russia’s energy demands continue to bolster exports of the world’s largest petroleum producer, with their overall increase in production linked to demand for oil

But change is brewing. Moving towards new East Asian markets, on February 17, 2011, Russia signed a deal to supply China with 15 million metric tons of oil over the next 25 years, in return for $25 billion in Chinese loans to Russian oil companies. Further investment in Asia and the North Sea are two of the top oil issues for Russia this year and in the near-future.

Oil prices rise as access declines

Prices have been climbing in recent months due to instability in the Middle East. In April 2011, the ever-fluctuating price of oil hit $110 a barrel. The International Monetary Fund expects oil to hover at $100 a barrel through 2012.

Campbell, the Oxford petroleum geologist, has championed energy reform around world. He told Marketplace he estimates that regular conventional oil peaked in 2004 and that regular conventional gas will likely do so around 2015.

“They are not high peaks and different data sets can shift them a bit, but the general pattern is becoming clear,” Campbell said. “I think that 2011 will see a steep fall in oil production due to the revolution in Libya.” But he expects things to recover in 2012, and be followed by gentle decline.

Crude oil in the U.S.

The third-largest oil producing nation in the world – the United States – hit its peak (for the lower-48) back in 1970, according to Campbell.

Still, change looms on the horizon. The EIA anticipates a decline in U.S. crude oil and liquid production over the next two years, in part due to last year’s BP oil spill and subsequent changes in Gulf of Mexico drilling regulations. In the wake of the largest oil spill in U.S. history, stepped-up regulations require companies to file once-voluntary safety and environmental plans, and be subject to increased governmental scrutiny.

Everything is bigger in Texas

The Gusher Age is over in West Texas, but that doesn’t mean the oil has stopped flowing there.

Despite being home to more than a quarter of all known U.S. oil deposits and accounting for 23 percent of all oil produced in the U.S., the Lone Star State has seen a steady decline in production in recent years, dropping more than 50 percent between the early 1980s and today.

Production dropped from a peak in 1972 due in large part to costly environmental compliance, declining reserves, and older wells that pump little oil and are expensive to operate. The average daily production per Texas oil well is fewer than nine barrels. The average oil well in Saudi Arabia produces about 6,000 barrels per day.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.