Why investors should thank the Fed

Share Now on:

Why investors should thank the Fed

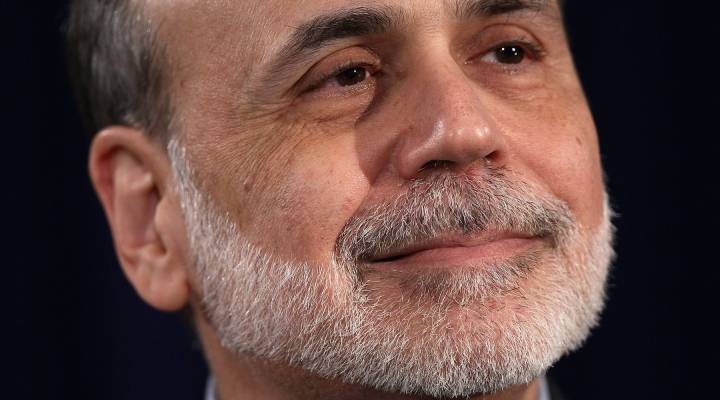

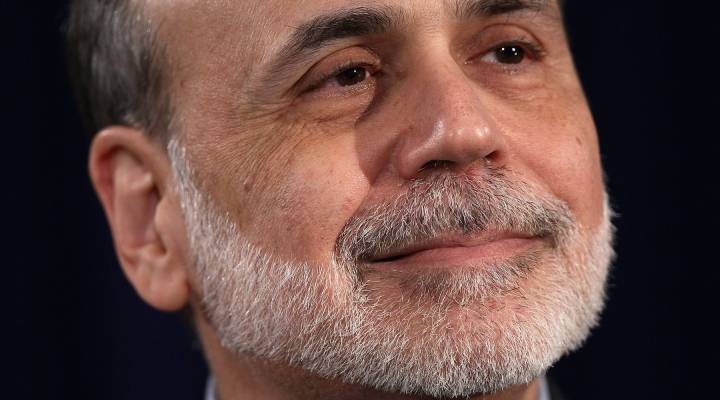

Stacey Vanek Smith: Yesterday Federal Reserve Chief Ben Bernanke said the economy still needs help. That probably means more stimulus and that interest rates won’t be rising any time soon.

Still Allan Sloan says investors should be thanking the Fed. He’s a senior editor at Fortune Magazine. Good morning, Allan.

Allan Sloan: Good morning Stacey.

Vanek Smith: So Allan, tell me: Why should investors thank the Fed?

Sloan: Because thanks to the Fed, U.S. stock market prices are much, much higher than they would otherwise be.

Vanek Smith: And how has the Fed helped stock prices?

Sloan: Because they did something that they called quantitative easing II — which is fancy for ‘printing money’ — in August of 2010, and in the six months after that, stock prices in the U.S. went up something like 28 percent, adding $3.5 trillion. Which a number of analysts who are not lovers of the Fed, say is due almost entirely to the Fed.

Vanek Smith: How do we know that that increase was due to quantitative easing and quantitative easing II?

Sloan: Well you can’t prove it, but you can’t really prove anything in the stock market. But as a fellow named Bob Waid, who’s a very well-regarded analyst at Wilshire — he attributes almost the entire six-month increase of $3.5 trillion to the Fed. And if he’s willing to do it, I’m willing to take his word.

Vanek Smith: Let’s look at the other side of this — how much has interest income dropped as stocks have risen? What’s the other side of this coin?

Sloan: Five years ago, before the world completely fell apart, you could get on money market funds and Treasury bonds and CDs something like 5 percent. Now the rate on CDs and money market funds is essentially zero. And the rate on a 10-year Treasury bond is under 2 percent, and you have to be an insane risk-taker to own one.

Vanek Smith: So how does this shake out in the end for investors? Stocks have gone up, interest rates have gone down. Who are the winners and who are the losers here?

Sloan: The losers are people who have nothing but interest-bearing investments.

Vanek Smith: Very safe investments, in other words.

Sloan: Right. People who either have to take more risk or lower their standard of living or eat into their principal if they’re retirees. And the people who’ve won are people like me who have a bunch of stocks and can afford to take chances.

Vanek Smith: A look at the other side of the coin.

Sloan: Indeed so.

Vanek Smith: Allan Sloan is senior editor-at-large at Fortune magazine. Allan, thank you.

Sloan: My pleasure.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.