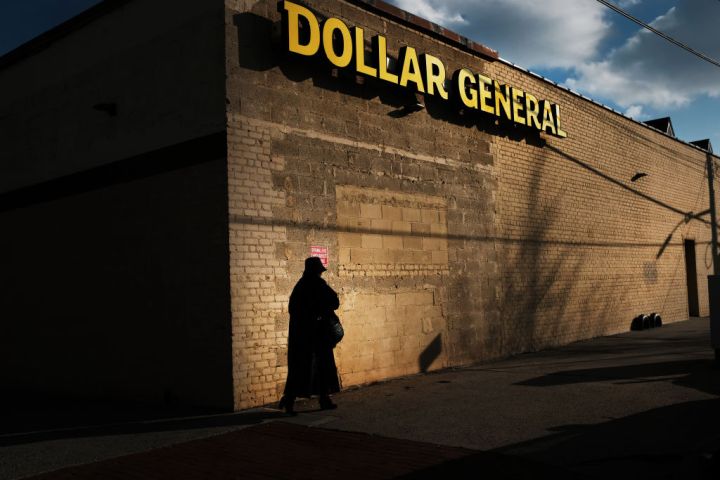

Tough Choices: How the poor spend money

“It’s stress,” Halima Tinson says as she paces back and forth in front of a San Diego preschool.

“But I want my husband to go to school. Because I know when he finishes, I won’t have to worry anymore.”

Tinson is trying to get her three-year-old twins signed up for the Head Start program to free up time for her husband. If her twins get into the program, Rickey Ricardo won’t have to stay home to watch the kids during the day. They’re too poor to afford good childcare. Any job that Ricardo could get wouldn’t pay enough to cover the costs of daycare. But free preschool means free time. Perhaps time enough to get some training and a well-paying job.

The Tinson-Ricardos are just one of thousands of poor families in San Diego. The poverty rate mirrors the national rate at around 15 percent. That’s 46 million Americans. Each person belongs to a family that has to make tough choices with their money all day, every day, just to squeak by. Marketplace Money talked to three families living near or well under the poverty line in San Diego about how they make these tough choices and what it means for their families.

Barely scraping by in deep poverty

Halima Tinson had to take three buses to get from her job across town to the preschool in the City Heights neighborhood of San Diego. This was the last chance to get the twins into Head Start. She’d already missed two other opportunities because the bus took too long to get her to the sign-up fair. For a poor family, a car can be the dividing line between getting by or going under.

“I just got my hours cut because my boss said I don’t have a car. And she said I wasn’t getting there on time to start my job,” Tinson says. She works about three hours a day at a charter school as a lunch lady. She makes around $500 a month now, but brought in $1,200 a month when she also helped out with janitorial work at the school. No car means not a lot of money. Tinson’s the primary breadwinner for the family while Ricardo stays home with the kids. With a yearly income of around $6,000, the Tinson-Ricardos are living well under the poverty line for a family of six, $30,847. It’s barely enough money to cover the rent of their four-bedroom, government-subsidized house on the edge of the City Heights neighborhood. Not to mention the water bill or electric bill.

“There’d be some times when we’d go without water for a whole week, maybe two weeks. I had to go get water all the way up the hill. My husband would go get water so [the kids] could take baths. It was a mess,” Tinson says.

Ricardo just climbed that same hill to get groceries for the family. He walks into the rust-colored living room with a half-filled bag on his arm, sweat rolling down his face. He handles a lot of the domestic duties like shopping and cooking. “It’s a science,” he says. “We have a budget. How am I going to get six people fed off of $20? Got some chicken and a head of lettuce and some tortillas, and we make it work. On a good day we can stretch it to $30 if we cash in some aluminum cans. That’s where you win.”

But looking around the Tinson-Ricardo’s home, there are some signs of better times… or bad decisions. Like two big-screen TVs that both sit in the living room. “They’re cheap,” Ricardo says. “We only spent $50 on that one and on this TV we spent $125. And we have cable. We have to, we have kids. We don’t have any entertainment. We have to.” There’s a bit of cognitive dissonance here. Clearly, the Tinson-Ricardos are poor. And just as clearly, they own two nice TVs. For poor families, every dollar they spend could land them under the microscope. There’s no room for error. And there’s plenty of judgment to go around [For a Harvard researcher’s take on why poor people make the decisions they make with their money, click here].

The Tinson-Ricardos have four kids living at home: Rickey Jr., 7, Isaiah, 5, Adora, 3, and Jonah, 3. These are not sheltered children. When Rickey Jr. bursts through the door after school, he’s got 11 cents in his hand. “They’re well trained,” Ricardo says. “They know every little bit counts.”

![]()

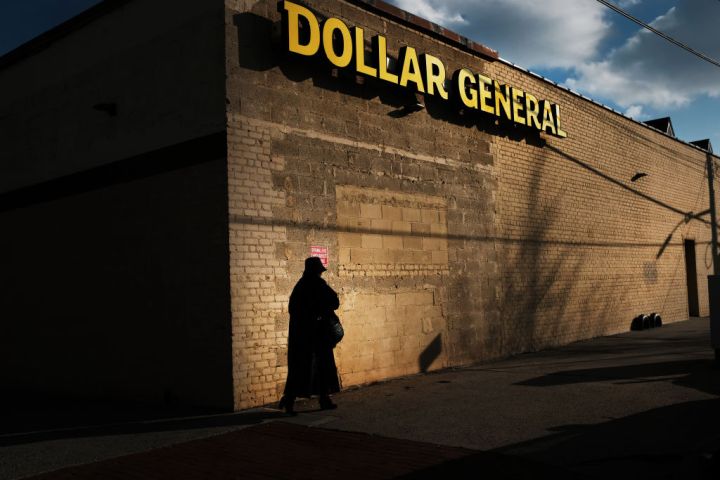

Rickey Jr. helps his dad collect recycling to make a little extra cash for the family.

And the kids contribute elsewhere as well. Their school requires that the family has Internet for the kids to complete homework. Ricardo gives plasma twice a week to cover the bill. And Rickey Jr. also helps. He participates in medical studies in order to bring in a little extra cash.

Living in poverty wears on a person. Constantly worrying about the rent, the water bill, school clothes for the kids, bus fare, groceries, the occasional injury — all that chips away at a person’s resolve to get by. But the Tinson-Ricardos find comfort where they can.

“I don’t roll with the economy, I roll with the lord,” Tinson says. “The lord says to live with prosperity. I don’t believe that I’m poor, I don’t say that. I just live like the lord wants me to live. Live with prosperity and that’s how I’m going to live.”

Ricardo has a more measured outlook: “I will say that we’re challenged. But we’re rich as far as the family is concerned. And that’s what keeps us going.”

From homeless to homeowner, living just above the poverty line

Twelve years ago, Alicia Ortiz had just escaped her abusive husband. She had nowhere to go, nowhere for her and her four kids to live. The children were placed in a temporary home, and she found refuge at a shelter in Escondido, Calif.

In June of this year, Ortiz became a homeowner for the first time in her life, something she always dreamed of, but never thought she could have.

“My favorite part is the chimney,” Ortiz says. “Since I was a little girl, I always wanted to have a chimney. For Christmas, you know, with a Christmas tree like on TV?”

![]()

Alicia Ortiz doesn’t know what it would take to be rich. But she says that with her new home, she no longer feels poor.

Ortiz grew up in deep poverty in Mexico City. Just like Ortiz, her mother was single and had four children, trying to feed her family on just pesos a day. Ortiz’ mother died when she was 15, so she came to the U.S. to live with her father.

“Over there poor means, like, really poor,” she says. “There was not milk in the refrigerator. That was a luxury. We didn’t have a toilet where you could flush it. That was poor.”

But even in the U.S., Ortiz was considered poor. And when she left her abusive husband, she joined one of the millions of people who experience homelessness every year.

She had nothing. But for Ortiz, that meant there was nowhere to go but up.

She spent four months living in the shelter, and while she was there, she took every financial literacy class that was offered.

“Back then I didn’t have my immigration papers, I didn’t know how to drive, I didn’t have a car, of course I didn’t have a job. It was not easy. But I learned how to drive, I filed for divorce, I got my immigration papers through the program for women who have been in domestic violence. I was able to get my permit for the first five years and after five years I had to show them that I was going to be able to support myself without getting assistance,” she says.

And little by little, she was able to achieve that level of financial independence. She was able to get back on her feet.

In the early years, she worked the graveyard shift at a local grocery store, stocking shelves in the middle of the night. Her lunch break was at 7 a.m. And it was just enough time to take the bus home, get the kids ready for school and take the bus back to work.

With the help of classes that taught her how to save money, she put away around $100 a month. Her down-payment fund got fatter and fatter until she had enough to buy herself a modest two-bedroom, two-bathroom condo in the northern part of San Diego. A community housing program matched her down payment, but saving up still wasn’t easy.

She laughs about it now. “I had to learn how to cut my kids’ hair. I went to Walmart and bought the little haircut clippers. The first time was not the best, but they were still little. I got better and better as time went by. We stopped going out to eat, I bought groceries and cooked at home. Another thing that I learned is to always look for the deals. Discount racks in the stores? I get shampoos, soap, toothpaste, bread. Always on sale.”

Ortiz works at a paint store now and makes $12 an hour. That puts her just above the poverty line for a family of three. Two of her children have moved out, two are still at home. But with her new home, she says she doesn’t feel poor at all.

“To be honest with you, there were several times that I was very discouraged and I thought I was never going to be able to make it. Being a single mom and making so little money, I thought it was not a possibility for me,” she says. “I just had to push through.”

Child poverty and blazing a trail to the middle class

One in five kids lives in poverty in the U.S. Up until this year, Bertin Solis was one of those kids.

He’s 18 now, and like a lot of 18 year olds, he’s headed off to college. Solis is trying to break through the odds stacked against him. The odds that are stacked against most poor kids.

Solis was born in Los Angeles at the bottom of the income ladder and he grew up in deep poverty. “We had to go days without eating. My meal would be like a simple bowl of beans. That would be all we had.”

When it comes to kids like Solis, only 4 percent born at the bottom will ever make it to the top. And even modest gains — climbing into the working class or even making it to the middle class — can seem impossible. But Solis is taking the first steps toward the middle class by going to college, the first one in his family to do so.

“I’ll be attending U.C. Santa Barbara. I want to go into law enforcement. I, myself, like helping other people so that would be a way that for sure I’d be able to help others,” he says.

For now, helping others means helping his parents out. He gets up at dawn each Saturday to go to work with his dad, a landscaper. “I’ve been doing it since I was 13. I wake up at five in the morning. We start working at six. We do a lot: We climb palm trees to cut off the branches, we mow lawns. It’s really tough because when it gets hot and there’s a lot of work, we have to be moving really quick to come out of work soon. Saturdays are the days that I wake up the fastest because the faster we go, the faster the work day is over. I mean, it’s all for my family so I don’t mind.”

![]() Which is why his decision to leave home, to go to school, isn’t necessarily an easy one. Without Solis’ added help and income, his poor parents will struggle even more than they do now. And Solis also serves as a translator for his parents, who don’t speak English.

Which is why his decision to leave home, to go to school, isn’t necessarily an easy one. Without Solis’ added help and income, his poor parents will struggle even more than they do now. And Solis also serves as a translator for his parents, who don’t speak English.

Solis’ mother, Edith Lopez, stays home with his toddler brother, Octavio. She says Solis leaving will mean a big change for the family. Solis translates from Lopez’s Spanish: “It’s going to affect them a lot because I’m the one that helps them out with almost everything here. Specifically my dad because he’s weak with illnesses.” Solis’ father has diabetes and a bad back.

But short-term pain will mean long-term stability for Solis. The lifetime earnings of a college graduate are 84 percent higher than a high school graduate. “By going to college, I’ll be able to come back and help them. Once I’m able to help them, I can have a good financial situation where I can support my future family too, so that they won’t have to go through what we’ve had to go through.”

Solis’ parents raised him in Mexico and then moved him to the City Heights neighborhood of San Diego when he was seven.

Solis decided early on that he wouldn’t waste that opportunity. He joined an after-school program called Reality Changers, a local nonprofit that helps build first-generation college students. The group provided tutors when Solis struggled in math. They prepped him for the SATs. And they helped him write scholarship essays when he was applying for schools. He graduated with a 4.1 GPA and a full-ride scholarship from the Gates Foundation. The scholarship will cover him all the way up through a Ph.D. should he choose to go that far with his studies.

Reality Changers showed Solis the path. But it was up to him to take it, which he did with relish. “I was part of the French club, I was part of wrestling team, the captain actually. I was also part of cross country, track and field. Some days I would go without sleeping, but it paid off.”

Solis probably isn’t done with all-nighters for good, but life is about to change for him. No more Saturdays trimming palm trees or mowing lawns. Not that he regrets helping out. “Doing that job helped me realize why I needed to go to college. You can either work with your mind or with your back. That’s how I saw it.”

Many poor children don’t see it that way, because what they do see is poverty and not opportunity. That’s when poor children become poor adults. Solis is the exception, not the rule, when it comes to economic mobility for poor kids. But should it be up to children to find their own way in the world?

“Yeah, it is up to the kids, but also, the people that you’re surrounded by will make you who you are. So if you’re surrounded by kids that have different mindets than you do, it’s going to be harder for you to go through the road that you want to go through. But also I feel that you need a lot of support from your parents too. Because if you don’t have no one who believes in you, you can’t really believe in yourself.”

As Solis packs up T-shirts, towels, notebooks and blankets in his bedroom, his mom drills him on their plans for the Saturday that she and her husband will drive him up to Santa Barbara — the day he sets off on the road to his financial future. He’s almost ready to go, but he has one simple question for his mother in the middle of the boxes and bags.

“Will you miss me?”

“Mucho,” she says with a bittersweet smile on her face. “Mucho.”

Megan Burks of Speak City Heights contributed to this report.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.