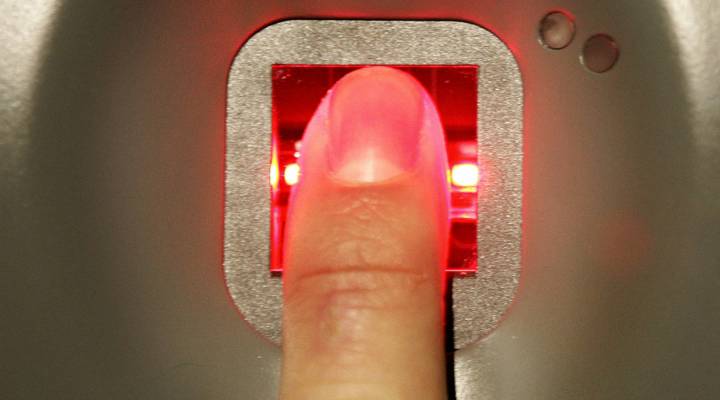

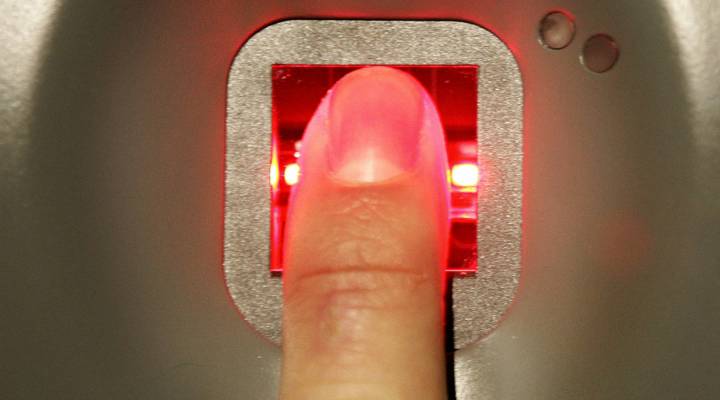

A credit card you have to activate with your finger

Credit card fraud is growing in the U.S.: 47 percent of the world’s card fraud takes place here. One company wants to help lower those figures with a biometric, fingerprint-activated credit card.

You don’t activate this card by calling a 1-800 number. Instead, you swipe your chosen finger across the card three times. Afterward, every time you use it, you use that same finger to identify yourself. A thief would be stuck with a useless piece of plastic.

Chaya Hendrick is CEO of SmartMetric, the company behind the card.

“We have talks and a very high level of interest underway at the moment from some of the biggest credit card issuers in the United States and in Europe and parts of Asia,” she said.

Ben Woolsey, president of Credit Card Forum, said fingerprint technology would add security in the event of a stolen card. Still, he said most card fraud “is when millions of card numbers and the information associated with those people are stolen off of merchant databases, card processor databases,” and fraudsters then use that to embark on an online spending spree.

He said the tighter security gets around the actual card, the more it’ll drive criminals to go after the data.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.