Georgia recognizes embryos as dependents, for a $3,000 state income tax deduction

Georgia recognizes embryos as dependents, for a $3,000 state income tax deduction

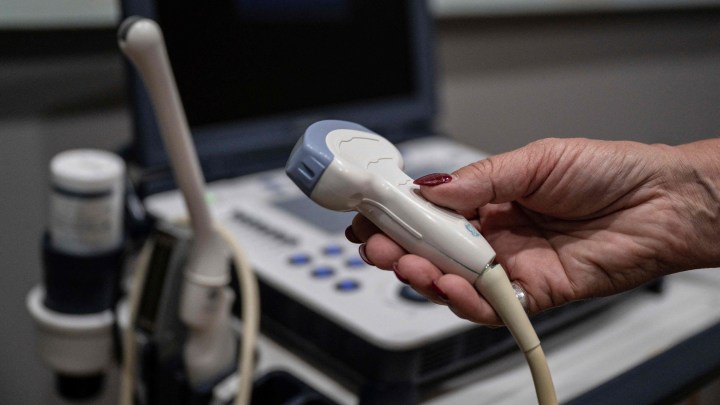

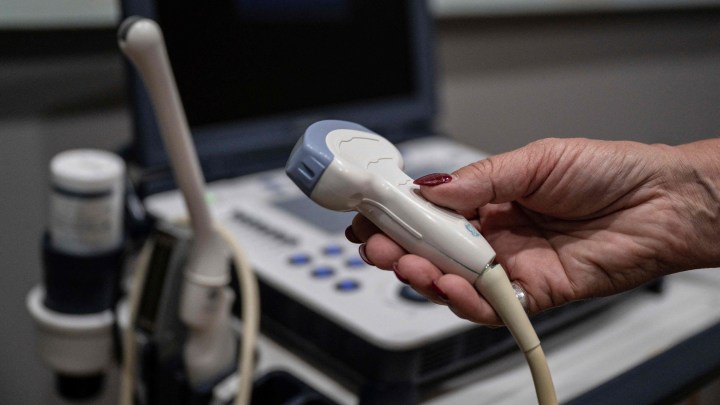

Mia was a few weeks pregnant when she saw her doctor. “They saw a heart flicker, and they confirmed that I was pregnant,“ she said.

Mia is the name she requested Marketplace use for legal reasons related to Georgia’s abortion law. Two weeks after that first visit, Mia got the devastating news that she had a miscarriage.

“At the appointment that they told us we were miscarrying, the doctor … (it might have been the ultrasound technician) … said, ‘You know, just to let you know, I think you can still get this $3,000 since there was a heartbeat detected.’ And I’m just like, ‘What?’ I don’t know, to me that just sounds completely absurd.”

But it is Georgia law. The state’s 2019 abortion law bans the medical procedure after about 6 weeks of pregnancy. It also recognizes an embryo as a person, and lawmakers decided that means people can claim them as a dependent on state income taxes as soon as the ultrasound detects cardiac activity. But certified public accounts like David Wilkerson wonder how it will work.

“Right now, the federal government — it still does not recognize the child before it’s born. And you have to have a social security number,“ he said.

Wilkerson is also a Democratic state representative, who voted against the law and said he warned his colleagues about complicating state tax filings.

For now, the Georgia Department of Revenue only issued guidelines. It says the $3,000 deduction for an embryo should be entered as “other adjustments” on the state tax form.

Ed Setzler is a Republican state representative who championed the personhood provision in the law. “I think this bill balances difficult circumstances women find themselves in,” he said.

But Andrienne Hills, who is expecting her second child next March, is not sure she’ll claim the deduction. She said it feels like payment for more government control over her pregnancy.

“OK, so we’re taking away a woman’s right to choose, but we feel so strongly about it that we give this tax credit. That felt very disingenuous to me,” she said.

She said she’s also worried about medical records the state may request from those claiming the deduction. The Department of Revenue has promised more details on the personhood tax credit later this year.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.