There’s a lot at stake with the student loan forgiveness application

There’s a lot at stake with the student loan forgiveness application

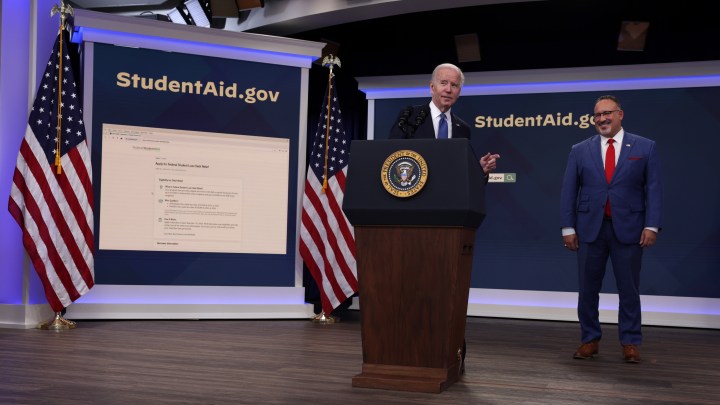

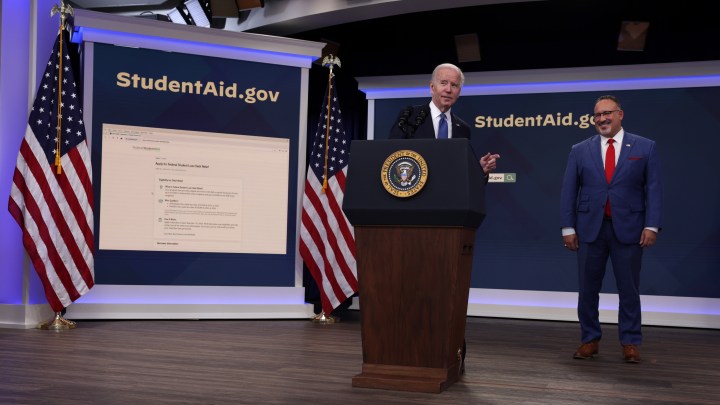

The Department of Education has opened its application for student loan forgiveness with a beta version launched over the weekend. That means the kinks are still being worked out, but if you submit an application, the site promises it will be processed. (Check out this explainer on student loan debt relief.)

With over 40 million people eligible for debt relief, this is the largest operation of its kind in the department’s history. The federal government has had problems with giant logistical operations in the past (remember healthcare.gov?), and there’s a lot at stake with this launch.

Eduard Van Osterom, 28, was reminded the form was up in a phone call with their mom last night, much like a parent would remind her child to do their homework.

“She was like, ‘Did you do it yet?’ in the way that moms do,” said Van Osterom, who’s now a public school teacher in Maryland.

So, Van Osterom did. They owe about $28,000 in undergraduate student loans. The form was super simple: First name. Last name. Middle initial optional. Social Security number. And ticking a box that said they fit income requirements. It was all so easy that it left Van Osterom feeling a little annoyed.

“I was like ‘Well, why couldn’t this just be applied automatically? All the information you asked me for you already have. You’re the government,’” Van Osterom said.

That’s a valid point, acknowledges Jon Fansmith, who works in government relations at the American Council on Education.

“It seems to defy belief that they can’t simply say, ‘Here are the parameters, put it into the system and do it automatically,’” Fansmith said. “But such is the nature of our current system.”

Fansmith points out that, legally, the IRS can’t share information with other federal agencies. So it’s on the Department of Education to verify income, find out whether applicants received Pell Grants and eliminate the proper amount of debt.

“It’s a lot. I mean, multiply that by 44 million people, there’s a very complicated process to do something that seems outwardly very simple,” Fansmith said.

A spokesperson for the Department of Education said the testing period will help it uncover any possible bugs before the official launch.

And there’s a lot riding on that launch. If the debt relief is delayed for any reason, even if it’s a reasonable one, consumers may not have patience for it, according to Betsy Mayotte, president of the Institute of Student Loan Advisors.

“I already had people this weekend that filed their application on Saturday, and Sunday night were asking why their forgiveness hadn’t shown up yet,” Mayotte said.

Then, those who have applied for debt relief are still left considering how the cost of college may affect them in the future.

Patrick Brickman, 37, lives in the Cleveland area. He applied for student debt relief Monday morning and is now thinking about the future costs of his 3-year-old daughter’s college education.

“I haven’t even looked at tuition,” Brickman said. “But I know that the schools I went to are now 60% more expensive than when I went there. And that cycle needs to be broken at some point.”

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.