How a “divorce” between the Treasury and Fed helped build the modern economy

How a “divorce” between the Treasury and Fed helped build the modern economy

The Federal Reserve’s final policy meeting of the year began Tuesday morning in Washington, D.C.

These days, the Federal Reserve sets interest rate policy independently from the executive branch, but that hasn’t always been the case.

In 1951, Marriner S. Eccles, who led the Fed from 1934 to 1948, made a decision that led to a split between the Department of the Treasury and the Federal Reserve, ushering in a new era for U.S. economic policy.

Leading up to that split, conflict was brewing between President Truman’s administration and the Federal Open Markets Committee (FOMC) over an interest rate policy that had been in place since the second world war.

The Second World War

“As the U.S. turn[ed] to war, there [was] pressure from Treasury on the Fed to keep rates interest rates low so that it would be easier for the Treasury Department to finance the debt,” said Sarah Binder, a Senior Fellow in Governance Studies at the Brookings Institution and a professor at George Washington University.

Low interest rates make debt cheaper. Because of the large amount of government spending required to fund the war effort, “the Fed agreed to peg interest rates and keep the long-term bond rate no higher than 2.5%,” said Robert Hetzel, a former economist with the Richmond Fed who has written three books on monetary policy history.

“The other side of this was that Marriner Eccles was worried that issuing debt could potentially foster inflation,” said Nina Eichacker, an assistant professor of economics at the University of Rhode Island. “Out of a commitment to the President and the Department of the Treasury, Eccles stifled those concerns and allowed the Federal Reserve to purchase [treasury] bonds as they were issued, in the process, keeping interest rates low,” Eichacker said.

“They saw it as an emergency measure,” said Binder.

But as time went on, Eccles and other Federal Reserve officials became more and more uncomfortable with keeping interest rates low.

Rising tensions during the Korean War

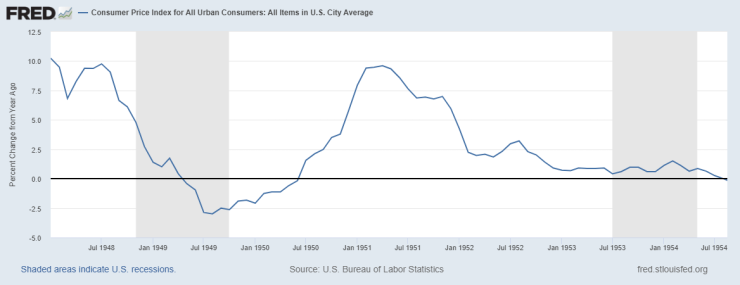

In June of 1950, when President Truman ordered U.S. troops into South Korea, inflation picked up in the United States. “Households [were] once again worried that they were going to face shortages and see rationing,” said Eichacker. “They start buying stuff up and [that] leads to an increase in prices.”

By January 1951, inflation had jumped to almost 8%.

Meanwhile, “Truman [was] very, very determined that the Fed continue this rate peg so he can finance the war cheaply,” said Hetzel.

That set the stage for conflict between President Truman’s treasury department and the Federal Reserve. At that point, Eccles was no longer chairman of the Federal Reserve, but still a member of the interest rate-setting Federal Open Markets Committee (FOMC).

As tensions rose, President Truman invited the FOMC to the White House. Though there was no resolution, the White House released a statement after the meeting saying the FOMC had committed to keeping interest rates low.

“The FOMC didn’t agree to that at all,” said Hetzel. “Eccles is outraged and so he leaks the story to the Washington Post and the New York Times that this was fabricated.”

“Eccles makes plain what happened, which is that that the White House and Truman had lied,” said Binder.

After the Fed’s account of the meeting got published in The Times and The Post, it became clear to Treasury officials congress would not support President Truman in this debate. “Treasury knows that it’s it’s in a box and Congress will no longer back it up,” said Hetzel. “So it knows it has to come to some kind of agreement with with with the Fed.”

The Treasury-Fed Accord of 1951

On March 4th, 1951, the treasury department and the Federal Reserve announced a new agreement. “We call ‘the accord,’ I think it’s more of a divorce,” Binder said. Whatever you want to call it, the agreement split government debt management from monetary policy, freeing the Fed to raise interest raise.

Here’s why that matters: “The move to split the connection between the Federal Reserve and the treasury facilitated the development of a gigantic private market for government debt,” Eichacker said.

The federal government has more than $31 trillion in debt on its books right now. Over the next couple months, congressional Republicans will likely try to leverage that debt for policy advantage.

“We take for granted that there will always be people and institutions and investors who are willing to buy up America’s debt,” said Binder. “The growth of the United States and our ability to respond not just to war abroad, but say to the global pandemic … depends on Treasury knowing that there’s a stable bond market….The availability and the strength of American debt comes out of that period.”

And you can— at least in part— thank Marriner Eccles for that.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.