Crypto marketing attracted a disproportionate number of Black investors. Here’s why.

Crypto marketing attracted a disproportionate number of Black investors. Here’s why.

Bitcoin had a pretty good start to the year, with a gain of almost 40% in January. But that’s after losing around 60% of its value in 2022.

Last year was hard for many crypto investors, with the collapse of FTX and other big scandals in the industry. And some of those losses were particularly keen for Black investors.

According to the 2022 Ariel-Schwab Black Investor Survey, last year a quarter of Black Americans owned crypto, compared to 15% of white investors. For comparison, the survey found that 58% of Black Americans own stocks, compared to 63% of white Americans.

“One of the other things that stuck out to us was that, strangely, the Black respondents that we surveyed perceived the stock market as more risky and less fair than their white counterparts,” said Arielle Patrick, chief communications officer at Ariel Investments. “So that perhaps contributed to their enthusiasm for crypto, which is new and shiny and perhaps has a far shorter track record with fewer crashes to note, because it’s newer.”

There was quite a bit of crypto marketing specifically targeted at Black consumers: The Super Bowl ad with LeBron James talking to his younger self, Spike Lee highlighting crypto ATMs, even ads encouraging crypto investments as a way to build generational wealth.

And the campaigns seemed to yield results, Patrick said. “Black investors are basically twice as likely to say that crypto was their first investment — 11% compared to only 4% of white investors.”

Terri Bradford, a payments specialist at the Kansas City Federal Reserve, found additional reasons why Black investors were more likely to get into crypto.

“The wealth gap was a major consideration in all of this, as was distrust of traditional financial services,” she said. “There was also interest in the ability of crypto — and the blockchain more generally — to democratize financial services.”

For much of American history, Black people have had limited access to institutions like banks and the stock market. Many saw crypto as a way to get around that system.

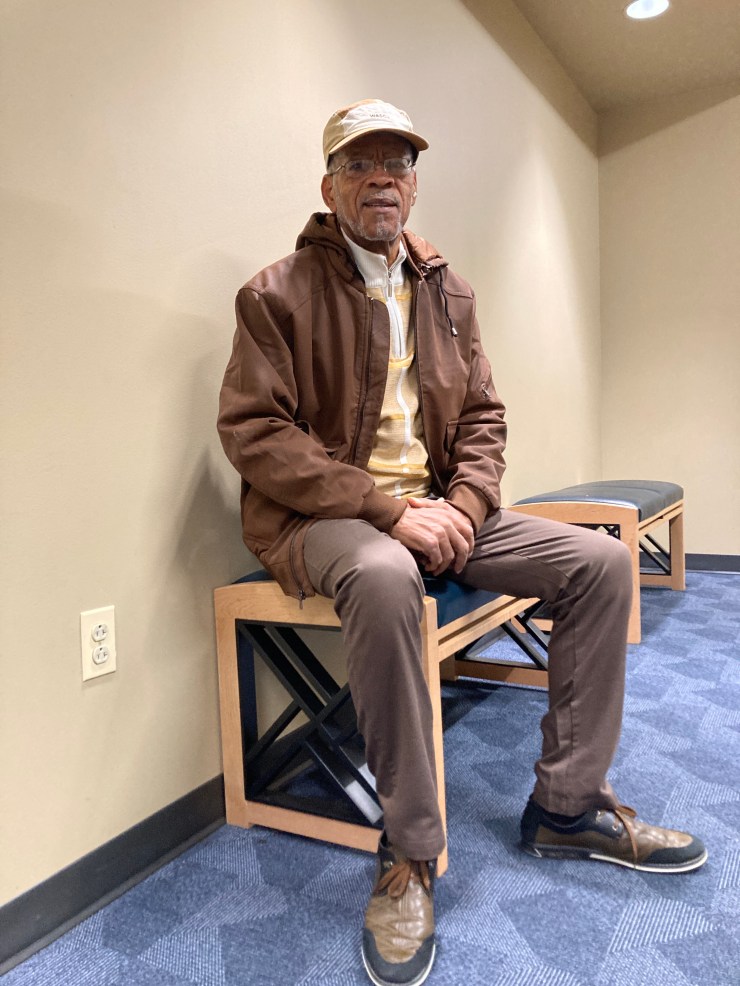

That’s what appealed to Randi Payton when he decided to start investing in cryptocurrencies. He’s an automotive writer and marketing consultant who lives just outside of Washington, D.C. He said he got involved in crypto via tokens and metaverse projects.

“The blockchain gives us the opportunity to not have to depend [on traditional banks],” he said. “We could tokenize our own projects and finance our own projects, whether it’s music or film. Once this thing catches on, you don’t have to worry about … the banks, the middleman.”

Bradford at the Kansas City Fed also pointed to the way crypto marketing became part of pop culture. “You could find it in lyrics, you find it in social platforms, so that component of it, as well, was attractive [to Black investors].”

Dan Runcie is the founder of “Trapital,” a newsletter and podcast that covers the business of hip-hop. He interviewed several hip-hop artists and business moguls as crypto rose to prominence and said there’s a reason these messages resonated in the Black community:

“There’s a broader exposure of who are the people that a lot of folks in our community look up to historically for years, and it’s more likely to over-index on athletes and entertainers than it may be for white folks or people from other backgrounds,” he said. “And then something like cryptocurrency comes up when it’s all heavy push from celebrity influencers and a lot of athletes and entertainers themselves, that then trickles down to then impacting Black investors and the fans of those folks specifically, who themselves are more likely to be Black, relatively speaking, than the overall population.”

But it wasn’t just celebrities pitching crypto. Anecdotes about cousins, high school classmates or former coworkers who suddenly made piles of money from investing in cryptocurrencies, NFTs or other metaverse projects also drew in many Black investors.

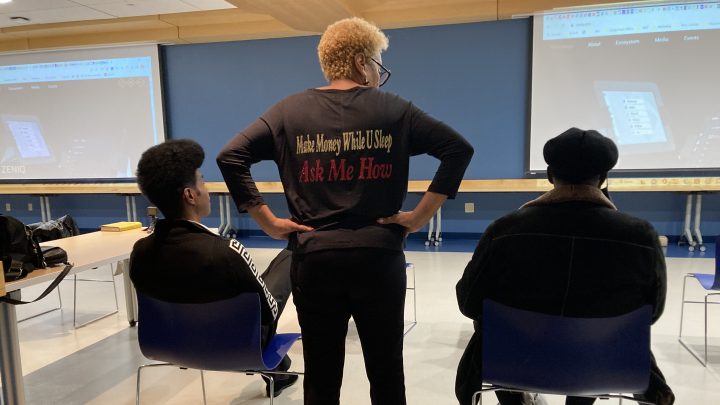

Randi Payton recently attended a presentation for a multi-level marketing business related to the blockchain and said he’s had success investing with such “networks” in the past.

“Once I got convinced,” he said. “I turned $2,500 into about $80,000 In less than a year.”

Payton said he withdrew most of his gains ahead of the crash last year. Despite the crypto crash — and the headlines and scandals — some investors like him still have faith in crypto and the technology behind it. But crypto’s success as an economic equalizer is still anything but certain.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.