Milton Friedman’s “long and variable lag,” explained

If you’ve been tuning in for one of 2023’s hottest shows — Federal Reserve press briefings — you may have noticed an oft-repeated phrase on the Fed chair’s lips: “long and variable lag.”

“It’s sort of standard thinking that monetary policy affects economic activity with long and variable lags,” Fed Chair Jerome Powell said in June. But the idea that the time it takes for the actions of central bankers — like raising interest rates — to work their way through the economy is “long and variable” has not always been “standard thinking.”

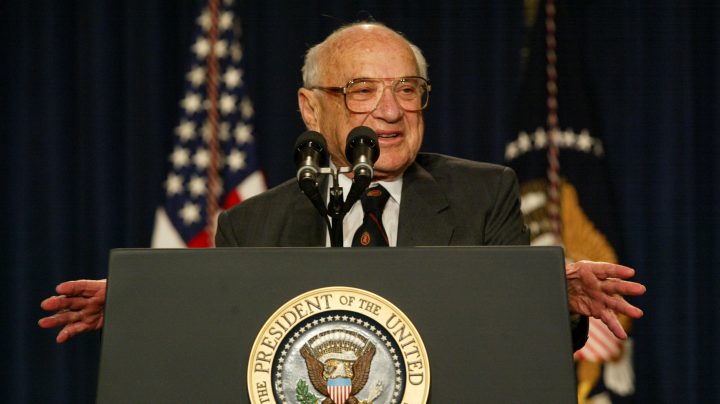

“Generally, the term is associated with Milton Friedman,” said Peter Ireland, a professor of economics at Boston College. Milton Friedman, the conservative University of Chicago economist and Nobel Prize winner, started talking about long and variable lags in the late 1950s.

“The long and variable lag is one of these nostrums that’s passed into conventional wisdom, but was not conventional wisdom when Friedman started talking about it,” said Jennifer Burns, a professor of history at Stanford University and author of a new biography of Friedman. “There’s a way in which we can miss how revolutionary a lot of what he said was because it’s just been incorporated into like, well, ‘This is stuff that everybody knows.’”

Though Friedman’s ideas have been revisited by economists again and again over the decades, that phrase he popularized — long and variable lag — still helps orient monetary policymakers today.

The history of “long and variable lags”

In 1959, Friedman told a joint session of Congress that monetary policies “operate with a long lag and with a lag that varies widely from time to time.”

At the time, the Federal Reserve had a philosophy of “leaning against the wind” — in other words, if the economy is getting too hot, the Fed should proactively raise interest rates to try to slow it down.

But Friedman believed that the effects of monetary policy were too uncertain for this to be an effective strategy. “We know too little about either these lags or about what the economic situation will be months or years hence when the chickens we release come home to roost, to be able to be effective in offsetting the myriad of factors making for minor fluctuations in economic activity,” he told Congress.

“Friedman became an economist at the moment that economics became extremely quantitative, model-driven, mathematical driven,” Burns said. Friedman believed in combining quantitative analysis with empirical observations. “And so that meant researching data, and it also meant looking at history,” she said.

In a 1961 article in the Journal of Political Economy, Friedman argued that the lag between an interest rate increase and subsequent slowdown in inflation were much longer than previously thought.

“It’s against the prevailing understanding of what economists and the federal government are doing, which was called ‘fine-tuning’,” Burns said. “Fine-tuning” was an idea promoted by advisers of President John F. Kennedy that economists could make small adjustments to the economy to speed it up or slow it down as needed — like a photographer adjusting the focus on a lens.

“Friedman never believed in fine-tuning,” Burns said. “He said, ‘We don’t know enough. It’s too complicated. If we try to fine-tune, we could end up creating very large and unexpected problems.’”

In 1972, Friedman wrote another paper called “Have Monetary Policies Failed?” “There, he says it can be up to two years before the full effects are found on inflation,” said Peter Ireland of Boston College.

During the 1970s, as the government and the Federal Reserve struggled to tame inflation, some of Friedman’s ideas were proven right.

“Now, it’s been a long time since then, economists have revisited the issue again and again, and I think it’s fair to say that the evidence is mixed,” Ireland said.

Long and variable lags today

Modern economists studying the lag between monetary policy and changes to the economy have found much shorter lags than Friedman did. Some of that relates to how the Federal Reserve communicates.

“There actually used to be a long and variable lag between the Fed doing something and people knowing what it had actually done,” Burns said.

In Friedman’s day, there was no public statement when the Federal Reserve raised interest rates, the Fed just did it.

“The markets had to kind of go figure out that the Fed was in there doing something,” said Christopher Waller, a member of the Federal Reserve’s board of governors, at an event in January. “That’s not how we do things anymore. We start telling people in advance.”

Economists today also have much more timely data than Friedman had. “Friedman [was] like a hero in a very data-poor environment,” said Vasco Carvalho, an economics professor at the University of Cambridge.

Today, economists have much more monthly, weekly, and even daily indicators they can use to study lags in monetary policy.

“Particularly during COVID, you may you may have seen this explosion of indicators,” Carvalho said. He and other researchers used some of these so-called high-frequency indicators to study the impact of monetary policy actions in Spain and found that household consumption declined in as little as five days following a central bank action. “Employment decisions are a little bit more sticky,” he said.

Carvalho pointed out that this is just one study looking at one country — more research is needed to validate their findings. “And while economists do understand much better than, say, when Milton Friedman was writing, these transmission mechanisms of how exactly monetary policy eventually goes into every crack in the economy is not still well understood.”

What that means for the Fed

Despite everything that’s changed over the past 60 years, that phrase — long and variable lag — still gives the Federal Reserve a framework for explaining the unknown.

“There was an old literature that made those lags out to be fairly long,” said Powell in a November press conference after the Fed raised interest rates for the sixth time in a row. “There’s newer literature that says that they’re shorter. The truth is, we don’t have a lot of data [consisting] of inflation of [rates] this high in what is, now, the modern economy.”

Said historian Burns: “I think what the concept of the long and variable lag does is tries to orient policymakers to a clear and consistent path, rather than one that’s too responsive to quarterly information about how the economy is doing.”

You could say that “monetary policy works with long and variable lags” has become Fed speak for “We’re not sure how things are going to play out, but we’re doing the best with the information we have.”

“That being said, I think Friedman would agree that one has to stick with a policy and let it work its way through the system,” Burns said. “And so to the extent that ‘long and variable lag’ gives the Fed some cover to do that, I think he would appreciate and understand that.”

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.