These startup health insurers tried to disrupt the market. Now, their customers are scrambling

These startup health insurers tried to disrupt the market. Now, their customers are scrambling

Lauren Gibbs always wanted to work for herself. A decade ago, she quit her full-time job and soon became a real-estate agent in Lakewood, Colorado.

“It just seemed like being my own boss was going to make more sense,” she said.

Health insurance was a big part of the change. With the creation of the Affordable Care Act, it was now much easier for her to buy insurance as an individual, even with a preexisting health condition.

She cycled through a number of insurance companies over the years, getting to know the intricacies of the market. Late in 2020, she was excited to sign on with a relatively new startup company: Bright HealthCare.

“I was like, ‘This seems like a pretty good deal. And I think that the health insurance industry needs some disruptors and some innovation,’” she recalled.

The company had competitive rates, a good network of providers and a nice website. It was part of a class of “insur-tech” startup companies, with billions of dollars in investor backing, who aimed to disrupt the health insurance market.

But it turns out some of these startups were burning through billions of dollars in venture capital and struggling to make their business models work — with serious consequences for customers.

Last December, with its insurance business foundering, Bright HealthCare pulled out of individual health insurance markets across the country. That affected nearly a million people with Bright insurance — including Gibbs, who had to scramble for a new plan.

Her next provider was another startup called Friday Health Plans. But it turns out it was also in deep financial trouble. State regulators in Colorado ended up shutting down the company in August, with the authorities in its four other state markets taking similar actions.

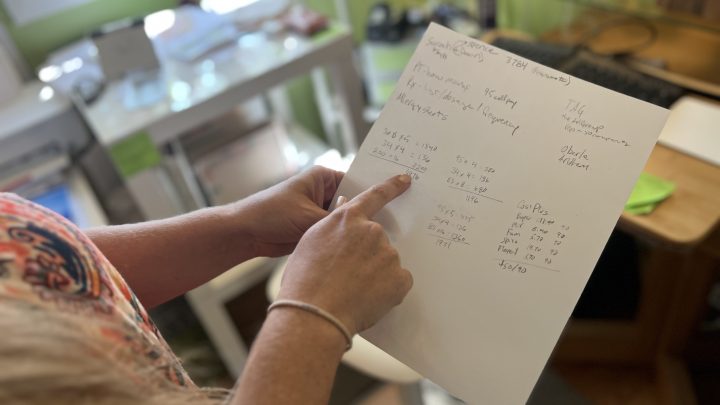

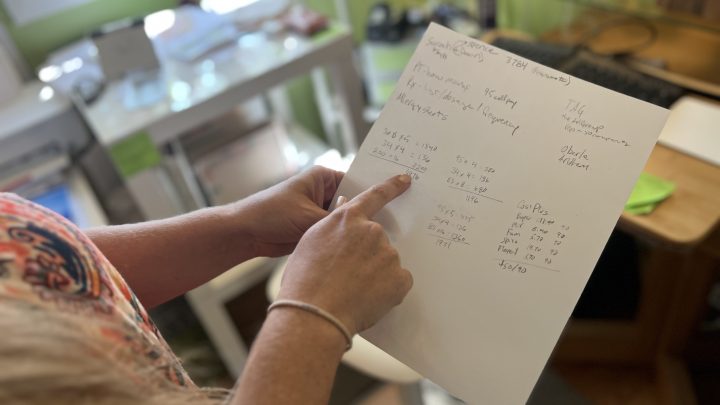

As a result, tens of thousands of customers in Colorado alone had to switch plans midyear, and many had to start all over on their deductibles. Gibbs estimates she’ll be out close to $3,000 if she doesn’t cut back her health care.

“The reason we have insurance is so we don’t have an unexpected expense, like $3,000,” she said.

Together, Friday Health and Bright HealthCare had collected more than $3 billion in investor funding. So what happened?

“They didn’t understand health insurance. Health insurance is really complicated,” said health insurance consultant Ari Gottlieb, principal at A2 Strategy Corp and a former director for PwC’s Health Services practice.

The startups drew customers in with low premiums, but that meant they weren’t taking in enough revenue to cover the health care expenses they were on the hook for, Gottlieb said.

Friday Health Plans, based in Colorado, became a particular concern for regulators as it struggled to keep up with its explosive growth nationwide, said state insurance commissioner Michael Conway.

“Because they started to lose money in a number of different markets, they started to set off some alarm bells for us,” he said. Conway added that the company’s leaders weren’t giving state regulators the full financial picture.

“In the case of Friday, they made very, very bad decisions at the management level, at the C-suite level, for years. That ultimately ended up leading to their failure,” he said.

Conway said state regulators did everything they could, but had to shut the company down midyear as financial worries mounted and medical providers started to lose faith that they would be paid by the company. Both Friday Health and Bright HealthCare are now largely out of the insurance business nationwide. Neither company responded to requests for comment.

But that’s not much comfort to customers like Lauren Gibbs.

“Having these two collapses in a row in Colorado, the state regulators, the governor, they need to pay attention to this and understand that these are real people’s lives and health on the line,” she said.

Gibbs has begrudgingly gone back to a much larger health insurer. She hopes this one will stay in business.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.