Fed chair Powell’s latest speech hints at caution regarding interest rates

Fed chair Powell’s latest speech hints at caution regarding interest rates

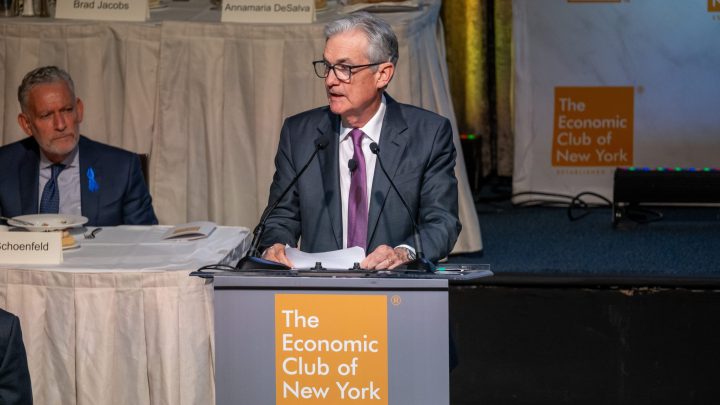

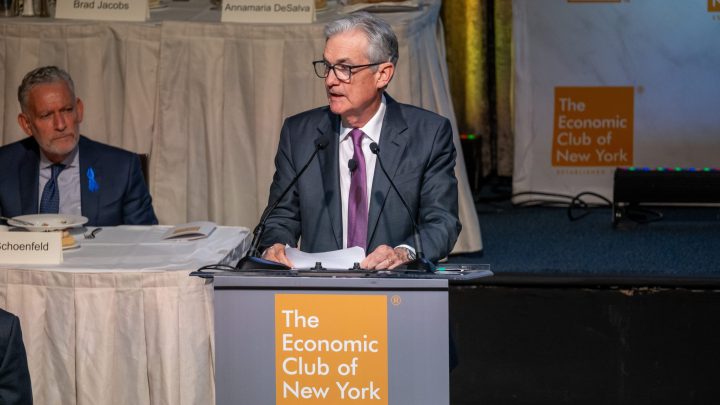

Federal Reserve Chair Jerome Powell offered a possible glimpse of what’s to come in lunchtime remarks at the Economic Club of New York, one of his last speeches before the Fed’s next meeting on interest rates Oct. 31 to Nov. 1.

The Fed’s playbook is raise interest rates to cool the economy and, hopefully, inflation. But some parts of the economy are still running hot: Consumers spent more than expected last month. And companies are still hiring.

So, “given the uncertainties and risks, and given how far we’ve come, the committee is proceeding carefully,” Powell said. Meaning the Federal Open Market Committee, which sets interest rates.

Powell is also keeping his eye on the yield, or return, on the 10-year Treasury bond. It’s been going up, and it loosely tracks with rates for some loans like mortgages.

So, New York Life Investments Economist Lauren Goodwin said, the bond market has been pushing up mortgage rates.

“And so in a way it acts just like the Fed’s own interest rate policy, although of course the Fed doesn’t control it directly,” Goodwin said.

Goodwin thinks all these things — the bond market, the uncertainty Powell mentioned — they’ll convince the Fed to hold interest rates steady in November. But, she said, Powell kept the door open to a rate hike at the Fed’s last meeting of the year, in mid-December.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.