Why would China sell off its U.S. debt — if that’s what it’s doing

Why would China sell off its U.S. debt — if that’s what it’s doing

The U.S. Treasury has been issuing quite a lot of debt to finance government spending. In fact, Tuesday it started auctioning off $112 billion in securities for this week. The total debt is nearly $34 trillion, but changes somewhat depending on how you calculate it. And about a third, or 30%, of the publicly held national debt is owned by foreign countries and foreign investors.

The biggest foreign holder of U.S. debt is Japan, followed by China. Which brings us to this: China appears to be offloading its U.S. Treasurys. If so, is that a problem?

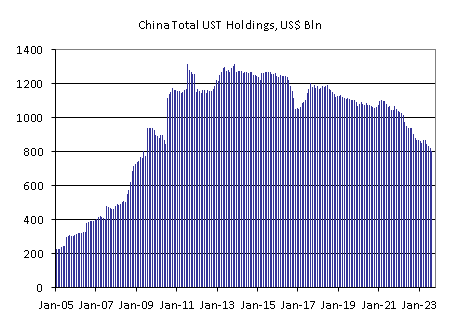

“Total Chinese holdings of U.S. Treasurys were about $805 billion as of August, and that’s the lowest since June 2009,” said Win Thin, global head of currency strategy at the bank Brown Brothers Harriman. Why China would be doing this, and even whether it is actually doing this, are hotly debated. One theory: “They have to sell these Treasurys to help support the yuan,” he said.

Selling Treasurys is a fast way to whip up U.S. dollars, and China will sometimes use extra dollars to go out on the global market and buy up their own currency. That artificially pumps up its value. It’s like planting someone at an auction to drive up your prices.

That’s one idea. Another is that China is ditching Treasurys because of trade.

“Trade barriers created under [President Donald] Trump and now continue under [President Joe] Biden explain a large part of the decrease in China purchasing U.S. Treasurys,” said Kent Smetters, a professor at the Wharton School.

With sand in the gears of international trade, China isn’t earning as many dollars, Smetters said, and therefore isn’t storing as many in Treasurys.

Finally, argument No. 3 for why China is getting rid of Treasurys is that maybe it isn’t. It just looks like it.

“China uses offshore custodians to hold some of their U.S. dollar-denominated assets,” said Christopher Vecchio, head of futures and foreign exchange for Tastylive, an options brokerage research group.

He said it could be that China is just hiding its Treasurys so people don’t poke around in its business.

Whatever the explanation, this all raises the question of why exactly do we care how interested foreign countries are in our debt?

“So we care about whether or not foreign governments or entities are buying U.S. Treasurys because it impacts the cost of borrowing in this country,” said Jesse Wheeler, senior economist at Morning Consult.

Here’s how that works. The government has to find creditors to meet its huge borrowing needs, and it casts a wide net.

“If that pool of people is just restricted to U.S. households, then the government is gonna have to pay a higher return on that debt in order to be competitive,” said Smetters of Wharton.

That would push interest rates higher — including those on home loans. So as long as they stay interested in our debt, Japan and China could be saving you money on your mortgage.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.