Criticism, crashes, and crises: Revisiting three ghosts of debt ceiling battles past

Criticism, crashes, and crises: Revisiting three ghosts of debt ceiling battles past

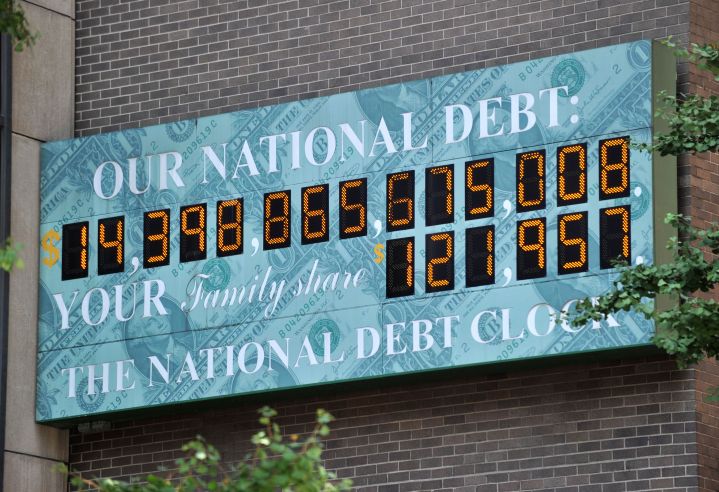

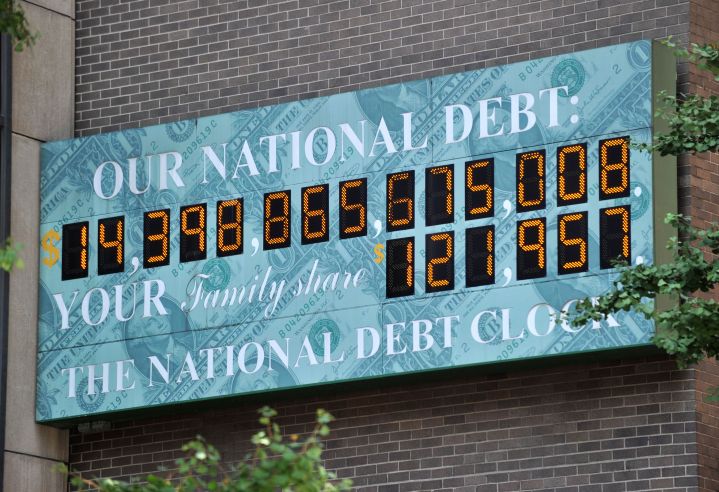

It’s hard to believe, but 2023 is almost over. Now we’ve entered that time when we take stock of everything that’s happened and bring those lessons into a new year. And 2023, if nothing else, was packed with lessons: Banks failed, crypto kingdoms toppled, eggs cost almost $5 a dozen at one point. And, of course, there was that massive fight over the debt ceiling. Except that last one — the debt ceiling — that is one lesson we can’t seem to learn.

In fact, there have been about 80 debt ceiling battles since 1960. But those decades of drama have never led to an actual default. In the end, Congress always finds a last-minute compromise, so we can keep paying our bills. But that doesn’t mean our debt ceiling ghost is friendly. The consequences of those perennial fights haunt us in all kinds of ways.

“The debt ceiling gives us a path to default,” explains John Chambers, former head of Standard and Poors Sovereign Debt Committee. The group gives credit ratings to countries (kind of like the FICO score individuals get). Chambers points out almost no other country has a debt ceiling.

“The debt ceiling means you can very easily see a path to default in the U.S. It could even happen by accident. That is not consistent with a AAA rating,” said Chambers.

In other words, these ever-intensifying games of chicken about whether or not we should pay our debts create a real risk that one day we won’t.

This was one of the main issues Chambers and his committee cited back in 2011 when they downgraded the U.S. credit rating for the first time in history: from AAA to AA+.

Granted, that might not seem particularly dramatic, but the effects were epic. The stock market fell hundreds of points, investors lost billions, and the White House reportedly came out swinging, saying S&P had miscalculated, calling the downgrade a “huge error” and “an enormous disservice to… your country.”

People even went after Chambers himself. “I got a lot of hate mail and death threats,” he recalls. Things got really scary when The New York Post published Chambers’ address. “I had a personal bodyguard assigned to me. Every time I went out to walk the dog, the guard went with me,” he said.

Still, S&P has stuck with that rating. It got company this year from fellow ratings giant Fitch, which downgraded the U.S.’s credit rating from AAA to AA+ in August, citing (you guessed it) the country’s recurring fights over the debt ceiling. And just last month, ratings giant Moody’s put the U.S. on notice, signaling that it, too, was considering a debt-ceiling-related downgrade.

But these downgrades, scary as they are, are not even the ghastliest ghost of debt ceilings past. For that, we have to go back to the very first debt ceiling fight, which happened exactly 70 years ago, in 1953. Dwight Eisenhower was president and U.S. debt at the time was about $275 billion. Expenses were running high, partially because of the Korean War, and the Eisenhower administration wanted more money.

“Eisenhower asked Congress for an expansion of the debt ceiling by $15 billion,” said economist Kenneth Garbade, who has studied the first fight. “The House of Representatives said, ‘OK,’ but the Senate turned him down.”

This was very bad news for Eisenhower. The debt ceiling was fast approaching, and while his administration continued to lobby Congress, it also went to work scrounging up cash and slashing spending.

Some government projects were axed, others were pushed off the books, including a Depression-era program known as Fannie Mae.

During the Depression, there were so many home loan defaults, banks had all but stopped making mortgage loans. They were just too risky. Fannie Mae was meant to address this by buying home loans from banks, so there was almost no risk for banks, even if the loans went bad. And that, in turn, meant people could get home loans a lot more easily. The program was a big success, but the debt ceiling issue created a problem for Eisenhower: All those mortgages went right onto the government’s books.

“Fannie Mae debt contributed directly to the national debt,” says Garbade. “So you were pushing up against the debt ceiling quicker than you otherwise would.”

The solution: Fannie Mae was rebooted into a private-ish, government-backed entity. No longer would the program use all government money, instead, it would have private investors, like a typical company. Of course, Fannie Mae was not a typical company.

And here is where our debt ceiling ghost rises again: Because Fannie wasn’t entirely on the government’s books anymore, the government couldn’t fully control it. At the same time, Fannie was still part of a government program, so it was never going to go under or go bankrupt because its rich Uncle Sam would always bail it out. At least, says Garbade, that’s what investors assumed give decades later, when they pushed Fannie Mae to buy up super risky home loans to fatten profits.

“That’s ultimately how we got into the whole Fannie Mae situation in 2008,” says Garbade. The whole Fannie Mae situation: Our scariest debt ceiling ghost. You might remember back in 2008, a whole lot of Fannie’s loans turned toxic and it started failing.

Garbade remembers when this went down. At the time, he was an economist at the New York Federal Reserve Bank. “I was shocked,” he recalls. “When the stuff hits the fan, it’s so quick and so unexpected that people are in a real tizzy, as my mother used to say.”

That tizzy ended up costing Uncle Sam nearly $200 billion in what would become one of the biggest bailouts in the country’s history.

In 1954, Congress did eventually agree to raise the debt ceiling. But that fight, over $15 billion, contributed to a multi-trillion dollar global economic crisis. A crisis that caused millions of people lose their homes, their jobs, and their savings more than 50 years later.

Which brings us to our final ghost: The ghost of debt ceilings present… or maybe we should say future. This year’s debt ceiling fight was officially suspended. It’s set to come back to haunt us in January of 2025.

The debt ceiling: A lesson, it seems, for another year.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.