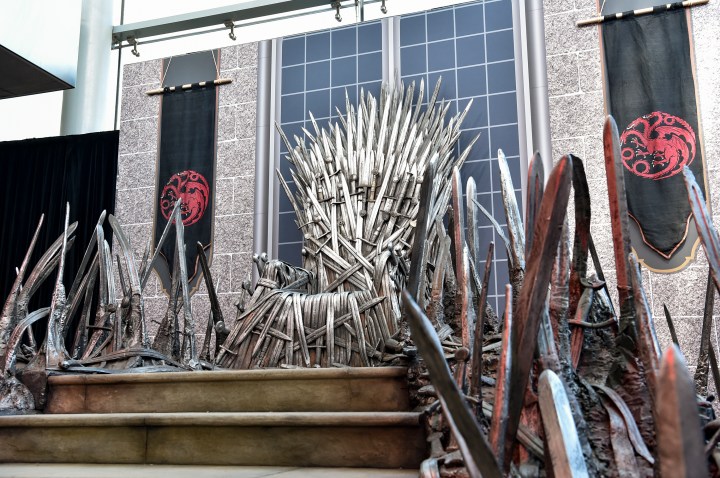

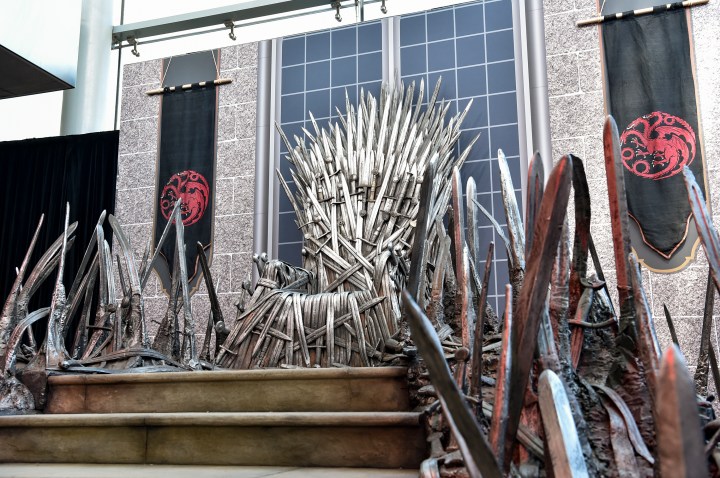

Think of the US Fed Chair as the economy’s “Iron Throne”

In the world of economics, Jerome Powell’s speeches are about as dramatic as it gets. In many ways, The Federal Reserve Chair is the U.S. economy’s Iron Throne.

When Fed Chair Jerome Powell speaks, markets all over the world surge or plunge. For days and weeks afterward, people pore over Powell’s every phrase looking for hints of what is to come: Is there reason to hope? Is an economic winter coming?

This week, the world was once again focused on Powell’s words as he took the stage for his regular press conference on Wednesday. “Good afternoon,” he began. “My colleagues and I remain squarely focused on our dual mandate to promote maximum employment and stable prices for the American people. The economy has made considerable progress toward our dual mandate objectives.”

OK, so George R.R. Martin probably isn’t shaking in his boots just now. Federal Reserve drama is that special kind of drama where you maybe start thinking about your grocery list in the middle of it. Still, make no mistake, the drama is real.

“We would take a lot of note about the language that he used,” recalled Ernie Tedeschi, former chief economist for the Council of Economic Advisors for President Biden.

Tedeschi distinctly recalled a moment back in March of 2020, just after COVID hit, but before the data had come in about how many jobs had been lost or what kind of damage the shutdown would do. In the midst of that chaos, the Federal Reserve issued a statement.

“They just said, straight out, ‘We are bringing interest rates down to zero or near zero. We are beginning to purchase treasuries and mortgage-backed securities,” recalled Tedeschi. “And you just step back and you’re like, ‘This is a game changer.’ This very simple, unadorned statement just had massive implications.”

That’s the Fed: No sound, no fury, signifying everything.

And the drama is pretty high right now. This week, everyone was waiting to see what the central bank would do, as pressure grows to lower interest rates. Would this be the meeting where it happened? A few minutes in, Powell unveiled the news:

“ Today, the FOMC decided to leave our policy interest rate unchanged,” he said.

Unchanged. This sounds very undramatic. But with an institution as powerful as the Fed, there’s no such thing as undramatic.

“With the Fed and interest rates,” said Tedeschi, “there are all of these reverberations throughout the economy.”

Case in point: the housing market, which was going gangbusters during the first part of the pandemic. Millions of people all across the country started snapping up homes with more space, more yard, and more access to nature. It was a time of all-cash offers and bidding wars.

“People were doing crazy things,” recalled real estate broker Helen Jeong. “People would say, ‘Whatever your highest offer is, I’m going to offer $10,000 more.’”

Jeong is a real estate agent in Lake Elsinore, California, a town near the mountains in the Inland Empire. Jeong said during the early pandemic, the housing market was extremely hot, but as interest rates rose, it went very cold.

“The housing market, it’s rough,” she said. “You listen to the builders talk, you listen to the realtors that are trying to sell the houses. Everyone is having a little rough time.”

A rough time mostly brought on by interest rates. Over two years, Jerome Powell raised interest rates 11 times, a move intended to bring down inflation, but that also hit the housing market like a thousand angry dragons. Home sales plummeted.

In Lake Elsinore, Helen Jeong said it went from all-cash offers and bidding wars to crickets, because as soon as would-be home buyers did the math, they realized how high their mortgage payments would be if they locked down that home they’d been saving for.

“With the higher interest rate, they’re surprised,” she said with a laugh. “And then they’re like, ‘OK, when I can afford it, I’ll come back into the market. So all of my buyers are sitting on the fence.”

Would-be homebuyers sitting on the fence is very bad news for all of the businesses that make money off of new home sales: movers, contractors, landscapers and decorators across the U.S. have reported slowing sales. Many report they have cut prices in an attempt to jumpstart business.

Of course, those price cuts represent inflation coming down, which is what the Federal Reserve wants. But they also represent the economy slowing down.

In the last few months, retailers like Best Buy and Lowe’s have said high interest rates are hammering sales, forcing store closures and layoffs. And all because of the words and actions of Jerome Powell and the Federal Reserve.

Until their next announcement in May, all we can do is wait to see what the Federal Reserve decides to do about interest rates — along with on-the-fence homebuyers, business owners, CEOs, world leaders, and global markets. We all wait for Powell to give the word. It’s pretty dramatic.

There’s a lot happening in the world. Through it all, Marketplace is here for you.

You rely on Marketplace to break down the world’s events and tell you how it affects you in a fact-based, approachable way. We rely on your financial support to keep making that possible.

Your donation today powers the independent journalism that you rely on. For just $5/month, you can help sustain Marketplace so we can keep reporting on the things that matter to you.