Amazon’s business dominance is a many-tentacled thing

It’s a big news week for Amazon. First, it got sued by the District of Columbia on antitrust grounds. The lawsuit accused the company of preventing sellers on its marketplace from offering better prices elsewhere. Then, in another part of its business, Amazon announced that it was acquiring one of the world’s oldest film studios, MGM, which was founded in 1924.

So even as big as Amazon is, it just keeps getting bigger, but not in one single market. I spoke with Rebecca Allensworth, a law professor at Vanderbilt University. She said that makes antitrust enforcement tricky and that it reminds her of another old company. The following is an edited transcript of our conversation.

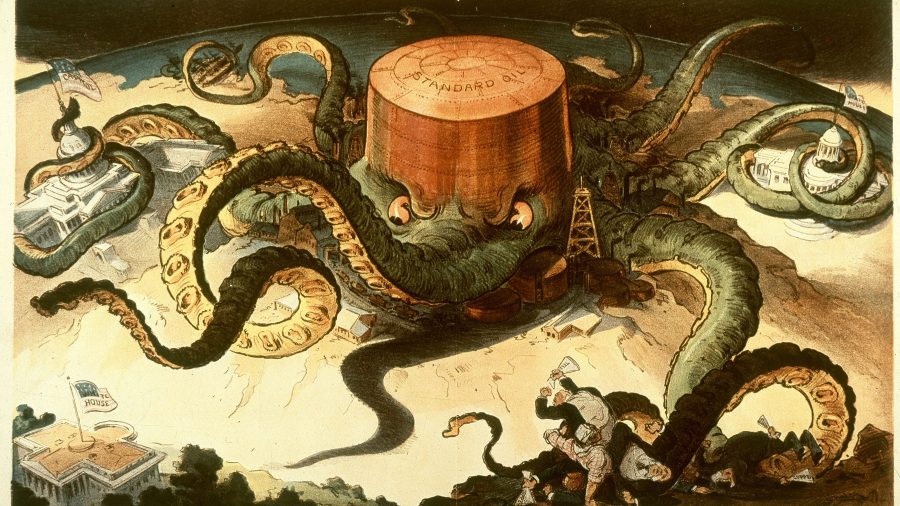

Rebecca Allensworth: There’s this great cartoon from the Standard Oil era of an octopus that’s got one tentacle in every area of American life. I like to think of companies, platforms like Apple and Amazon and Google as being an octopus: every tentacle is a new set of products. Amazon sells us stuff and delivers it to our house, but they also have streaming, they also have music, the list goes on and on. And the octopus phenomenon is problematic because if you’re going to switch, if you’re going to really exert competitive pressure on Amazon as a consumer, you’ve got to switch to another octopus. Unless you want to reenter your password a million times and deal with all the cognitive load of going to a million different websites, you kind of want that store for everything.

Molly Wood: Well, I should point out here, though, that the Supreme Court did order Standard Oil to break up in 1911 for violating the Sherman [Antitrust] Act, right?

Allensworth: Yeah. And the analogy, I don’t want to make it too tight, because there’s a lot of differences in the way these companies are structured. And also, that was 100 years ago. So we’ve really come a long way away from that mentality. It’s being revived, but there’s a lot of case law entrenched in that 100 years that will be hard to overcome.

Wood: Which is why, I think in some ways, now we’re seeing a question about whether the law needs to evolve.

Allensworth: Yeah, and of course, there’s two ways that the law can change, at least. One of them is through the case-by-case method, through the common law, as it has since Standard Oil, or it can change by statute. And I think that the answer is going to be some of both.

Wood: And then I guess, should we also not count out the market? Like, is there a nonregulatory solution that’s a combination of consumer sentiment and possible competition?

Allensworth: It sure doesn’t look that way. It sure is hard to imagine anybody but perhaps another one of the Big Tech four or five, depending on how you count, competing. I mean, Facebook toppled Myspace. And they really like to cite that as this idea that this dominance is fragile. But there hasn’t been a new Facebook in 10, 15 years. It’s really hard to imagine it emerging naturally out of the market.

Wood: I want there to be a new cartoon that is the American consumer in a dive cage encircled by octopi.

Allensworth: That would be terrifying and perhaps accurate.

Wood: It seems like what needs to happen is China needs to take down the firewall because that’s the only other place that’s incubated octopi of similar size.

Allensworth: Yeah, that’s true. I mean, Huawei and Alibaba could be the next big octopi.

Wood: I’m fascinated. I always joke that that’s the eventual Godzilla vs. Mothra situation that’s going to happen [with] these titans.

Allensworth: I love the giant sea monster feeling for that.

Related links: More insight from Molly Wood

Look, everybody knows that if you’re going to fight a monster, you go get a bigger monster, unless it’s “War of the Worlds” and you’re utterly helpless while the monsters rampage until nature takes care of it for you. I think I’ve pushed this metaphor about as far as I can.

Jeff Bezos spoke at Amazon’s shareholder meeting Wednesday and said it bought MGM for its deep catalog, and so it could potentially develop spinoffs based on that library. That could be tricky with the “Bond” movies. The producers have a lot of control over that franchise, but MGM also owns “Robocop,” “Thelma & Louise” — and it may not surprise you that I’m into this one: “Tomb Raider.”

There’s this Wall Street Journal story from 2019 that basically said: What if Jeff Bezos just fell in love with Hollywood, and that’s why he wants a studio? So who knows. The chair of the House antitrust subcommittee, David Cicilline, a Democrat from Rhode Island, was already badmouthing the deal on Twitter, as were other lawmakers. But Deadline reports there may not be much Washington can do about it under existing antitrust law. And, in fact, the last time the Justice Department sued to stop an entertainment merger, it lost. That was the AT&T-Time Warner deal that’s now being unwound.

Rebecca Allensworth told me that even in the D.C. antitrust case over Amazon’s treatment of third-party sellers, it’s a tough road to victory, and cases like these traditionally haven’t succeeded. I pointed out that the D.C. case isn’t unlike the lawsuit Epic filed against Apple over its treatment of third-party apps and developers. We’re not expecting a ruling on that for a few weeks, at least, but Allensworth said if Epic won — although it wouldn’t be a legal precedent — it could be a small step toward more antitrust scrutiny, even a bit of permission for future judges.

With respect to that lawsuit, the D.C. attorney general says Amazon punishes third-party sellers if they sell their goods for lower prices somewhere other than Amazon. Amazon says the D.C. circuit court has the issue exactly backward and that sellers set their own prices on Amazon and that D.C.’s lawsuit would lead to higher prices.

The future of this podcast starts with you.

Every day, the “Marketplace Tech” team demystifies the digital economy with stories that explore more than just Big Tech. We’re committed to covering topics that matter to you and the world around us, diving deep into how technology intersects with climate change, inequity, and disinformation.

As part of a nonprofit newsroom, we’re counting on listeners like you to keep this public service paywall-free and available to all.

Support “Marketplace Tech” in any amount today and become a partner in our mission.