Swiping, tapping or clicking may have you spending more than you would with paper money.

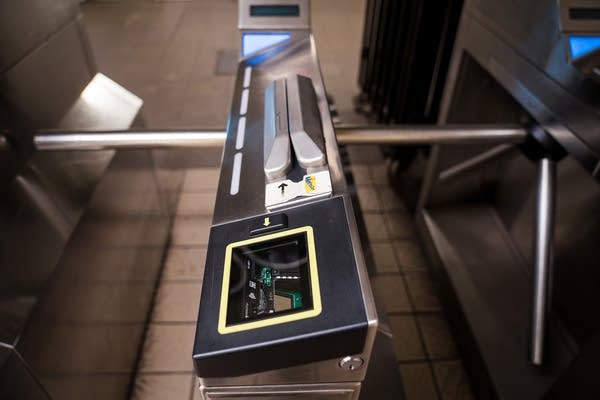

Online retailers try to keep it simple so you don’t abandon your cart. You can store your card details, buy with one click or just hit “buy again.” Paying in brick-and-mortar stores keeps getting smoother, too.

Today, it’s almost possible to leave your wallet at home and pay using your phone. In the not-too-distant future, stores could even use facial recognition or fingerprint scanning so you don’t need any device — just grab your items and walk out.

Consumers seem to want this frictionless payment as much as retailers do. But why? I put that question to Kit Yarrow, a consumer psychologist and author. The following is an edited transcript of our conversation.

Kit Yarrow: There’s a number of surveys that show that anxiety is on the rise, and everybody is really experiencing more day-in and day-out anxiety. What that does is it depletes our resources, and we gravitate towards anything that makes our life easier. We want everything to be more seamless; we have much less tolerance for any hassle or impediment to getting done what we want to get done. Another reason why we want things to be easier today, why we kind of bristle at any hurdle in payment, is because we are trained through our online lives to want things to be really seamless. Today we can get answers, insights, entertainment, everything we want so easily on our computers online. We look for that now in other areas of our life.

Jack Stewart: We see these innovations we’ve been talking a lot about — the Apple credit card recently, and that links with your phone so you can just pull out your phone and tap and pay — but how far could we see something like this go?

Yarrow: Innovation is really intoxicating to consumers, and retailers that use innovation are seen as caring more for some reason — they’re trying harder to get my business, they’re trying harder to make my life easier. I think right now, there’s a lot of innovation out there that consumers are a little skeptical of, like facial recognition, for example, that I think a few years from now will be common. If we go back and look at when ATMs came out, people were freaked out by that, [like], “I’m not going to put my money in a machine.” Now of course, we can hardly imagine actually going into a bank to get money.

Stewart: Is there any downside to this? It sounds like this is great, it’s just going to make life easier for shoppers everywhere.

Yarrow: Huge downsides, huge. I think consumers really have to be aware that the easier it is to pay, the more they’re going to spend. What we see is, for example, credit card debt is on the rise, and some of the categories where it’s boosting up the most are things that are easy payment issues. Ride-sharing, for example, fast food that you can pay for on your phone, these categories of debt are rising and consumers’ use of credit cards. Part of the reason for that has got to be that there’s less thought and consideration given to purchases when it’s easier to pay. We know that when people pay with cash, they spend less money than credit cards. We know that when people pay with gift cards, they spend more money than with credit cards. We know for sure that when people use instant payment, they spend more money, especially on hedonic purchases than they would otherwise.

Stewart: Is there some financial literacy element needed here? If we accept that this is the future, what can we do to make things better for consumers?

Yarrow: I always feel like if people really understand how money leaves their possession, they’re going to spend better. Research actually has proven that people do spend money more fluidly when it’s easier to pay. Just knowing that I think would help people to put the brakes on a little bit. If you can’t trust yourself, then do it the old-fashioned way. I think one of my favorite examples is almost all the consumers I interview have one story or another of when they went to buy something but the line was too long, or they had to enter their credit card, and they’re upset by this and they end up not making that purchase. Then they can’t even remember what it was they wanted to buy. Time is always our friend when it comes to evaluating purchases. If people can spend a little bit more time, whether it’s through the hassle of payment or whether it’s forcing yourself to just wait and think twice about something, I think they’ll make better decisions.

MarketWatch has a story that details some of the attempts Big Tech is making to remove the last physical barrier between our bodies and corporate America.

Thinking about this in depth has made me consider how much more thoughtlessly I’ll pay for something when I insert — or, these days, tap — my card than if I pause to count out cash. It’s something that we’re all likely to do more as phone payments become more common. But, as Kit Yarrow said, there are pitfalls. We’ll link you to some of the science on that, in particular a study from the University of Illinois, which looks at Alipay, a popular platform in China. It found that people made 23% more purchases and spend 2.4% more per transaction.

I also suggest you check out Marketplace’s site and click on “Check Your Balance,” our personal finance series. There are some great stories that help make sense of that interface of tech, money and your personal life.