How GE made history: a look back at an iconic conglomerate

In April, General Electric split itself up to focus on wind power, aerospace and health care. Its finance and media divisions are long gone.

When General Electric split into three separate businesses last month, the transition marked the end of a storied company that was for decades a fixture of American life — providing millions of families with everything from appliances and light bulbs to mortgage financing.

From the beginning of its 132-year history, GE was at the forefront of innovation. That applies even to some of the events that occurred before its founding.

It was in 1877, arguably, that spoken words were first recorded and replayed. Those words were a nursery rhyme, and they were spoken by Thomas Edison:

“Mary had a little lamb, its fleece was white as snow. And everywhere that Mary went, the lamb was sure to go.”

The original recording was destroyed, but Edison rerecorded it decades later.

In 1892, years after Edison invented the phonograph, one of his companies merged with another electric company to form General Electric. It wasn’t Edison’s idea. It was J.P. Morgan’s — the original J.P. Morgan. Like, the guy.

GE ushered in the age of electricity, and it was big from the get-go.

“You have to think of it as sort of the Microsoft, Google, Apple, Amazon, Meta of its time,” said William D. Cohan, author of “Power Failure: The Rise and Fall of an American Icon.” Edison was a better inventor than businessman and was quickly sidelined from leading the new company. But it continued to create.

“In the 1910s and 1920s, it quickly became a powerhouse of invention, innovation,” Cohan said.

GE inventors developed X-ray tubes and radio voice broadcasts. They created an electric car and an electric train. In the ’20s, GE got into home appliances. It built the first U.S. jet engine in the ’40s, and by the ’60s it was making the plastics and silicones used in the moon landing. GE invented Silly Putty.

It also got into the credit business, which, Cohan said, “started during the Depression to help people buy GE products they couldn’t otherwise afford.”

By the middle of the 20th century, GE came to be seen as ubiquitous because … it was. A 1950s television commercial declared, “At General Electric, progress is our most important product.”

GE had a tense history with labor unions from the beginning, and that drove several important decisions. As early as the ’40s, GE started moving plants overseas, said Elizabeth Tandy Shermer, a history professor at Loyola University Chicago, “and part of that is actually its dislike of organized labor.”

GE’s desire to escape unions helped spur the company to move its computing department away from what would become California’s Silicon Valley to Phoenix. “Part of it is Arizona has antiunion laws, more favorable labor and tax policy,” Shermer said.

That decision proved fateful. The company that made everything from A to Z ended up losing out on C — computers.

Despite making early strides, “they don’t do much in computing,” Shermer said. “Because GE computing was so removed from that hotbed of computer technology, computer innovation, they really got left behind.”

But one product GE launched in the ’50s surpassed everyone’s expectations: Ronald Reagan.

GE hired then-actor Ronald Reagan in 1954 to host a TV series it sponsored called “General Electric Theater.”

“But that’s not all Ronald Reagan does for General Electric,” Shermer said. “He actually goes on plant tours. And he’s there preaching the kind of gospel that it’s actually the manager — not your democratically elected union leader — who is in your best interest.”

Under the mentorship of GE executive Lemuel Ricketts Boulware, Reagan became more conservative.

“It’s an important moment, not just in terms of Ronald Reagan’s acting career at a moment when he’s struggling, but also in terms of a shift in Ronald Reagan’s politics,” Shermer said. “He had been a New Deal Democrat.”

By 1999, GE employed 340,000 people worldwide, with nearly 200,000 of them in the U.S. It was still the quintessential conglomerate. It made nuclear reactors and the engine for Air Force One. It made manure spreaders and owned “Saturday Night Live.” And there was a rationale.

“That was this notion that some degree of the research would be shared across these industries,” said Ted Mann, a reporter at Bloomberg and co-author of “Lights Out: Pride, Delusion, and the Fall of General Electric.” “If they were inventing something for the health care business, some of that research and development might in turn fuel the development of a product that could go into the oil and gas business,” the thinking went.

Over time, that argument became less credible to investors, and conglomerates went out of fashion on Wall Street.

While it was theoretically true that one tentacle of GE could help the others, it could also bring them all down. And GE’s financial arm almost did both.

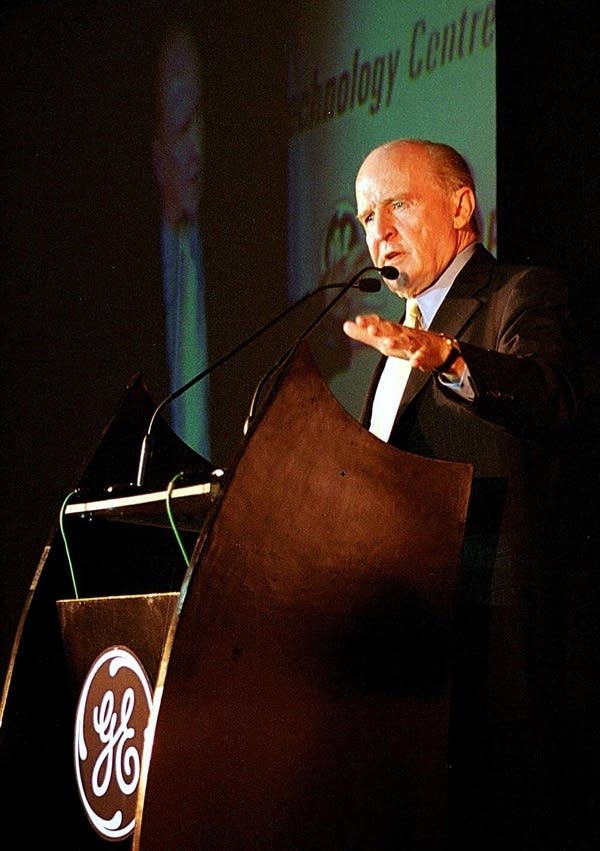

Under the company’s most famous CEO, Jack Welch, GE Capital had exploded — a far cry from GE’s foray into appliance financing decades earlier.

“That grew into what was essentially the seventh-biggest bank in the country,” Mann said.

At one point, it generated 50% of GE’s earnings, as Cohan recounted in “Power Failure.” When the 2008 financial crisis hit, GE Capital began to implode. It nearly took all of GE with it before being bailed out, along with the too-big-to-fail banks.

“Right then is where things really began to change,” Cohan said.

Under CEO Jeff Immelt, GE sold NBCUniversal to help pay for the fallout of the Great Recession and return to its “industrial roots.” GE Capital was spun off.

GE made what Cohan calls a catastrophic investment in a French industrial conglomerate, Alstom. And GE’s diverse industrial tentacles were chafing at being tied together, Mann said. “I think there was a realization that the only way for these companies to thrive and survive was to separate it all.”

It took two more CEOs, John Flannery and Lawrence Culp, to accomplish that. By 2021, General Electric’s U.S. headcount had fallen by almost 75% from its peak. Finally, in April of this year, GE split into a wind power company, a health care company and an aerospace company.

It is no longer the ubiquitous conglomerate whose products touched both moon and Earth.

“It was this incredible industrial company and built truly incredible things,” Mann said, adding that we shouldn’t expect to ever “see a company that looks like that again.”

Even the greatest of companies don’t have fate on their side forever.